Windsor Property Deeds

The Windsor Town Clerk maintains all deed records and land documents for property located within the town. As part of Hartford County, Windsor follows Connecticut's town-based recording system where each municipality keeps its own land records. You can search for deeds, mortgages, liens, and property transfers through the Town Clerk office or online databases. The office is located at 275 Broad Street and provides both in-person services and electronic recording options through approved vendors. You can access these land records to verify ownership, research property history, and obtain documentation for real estate matters.

Windsor Quick Facts

Town Clerk Office

The Windsor Town Clerk handles all land record filings for the town. You can file new deeds, search existing records, and obtain certified copies at the clerk office. The office is open Monday through Friday during standard business hours. Walk-in customers can search the land record index or request copies. Staff can help you locate specific deeds if you know the property owner name or address.

Address: 275 Broad Street, Windsor, CT 06095

Phone: (860) 285-1927

Hours: Monday - Friday, 8:30 AM - 4:30 PM

For questions about land record searches or recording requirements, call the office before visiting. Staff cannot provide legal advice but can explain the recording process and fees. Bring valid identification if you plan to record documents in person.

Online Land Records Access

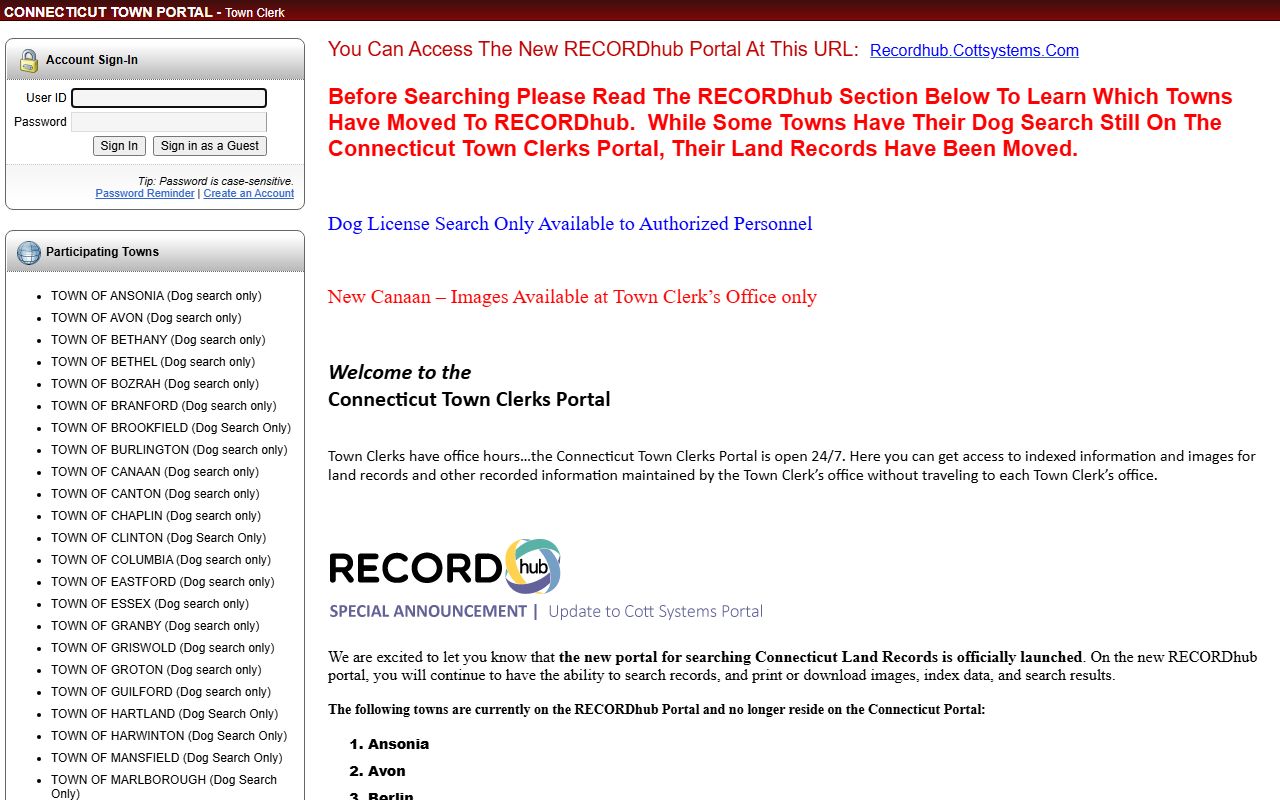

Windsor participates in the Connecticut Town Clerks Portal, which provides 24/7 access to indexed land records and document images. You can search by grantor name, grantee name, document type, or date range. The portal is free to search, though printing or downloading documents may require a subscription. Many Windsor deeds dating back several decades are available online.

You can also use US Land Records to search for Windsor property documents. Select Windsor from the town list and enter search criteria. The system shows book and page numbers for each recorded document. This helps you verify property ownership, check for liens, or research title history from home.

To search effectively, you need one of these pieces of information: property owner name, street address, approximate date of transfer, or book and page number. The index covers all types of land documents including warranty deeds, quitclaim deeds, mortgages, releases, liens, and easements.

Recording Fees and Requirements

Windsor follows Connecticut state recording fees. As of July 1, 2025, the fee is $70 for the first page of any document and $5 for each additional page. Documents involving MERS nominees have a first-page fee of $160. Copies cost $1 per page, and certification adds $2 per document. These fees are set by Connecticut General Statutes Section 7-34a.

Documents must meet state formatting requirements. Use white paper in standard letter or legal size. Black ink only. Font size at least 10 points. The grantor must sign, and a notary must acknowledge the signature. Two witnesses are required, with the notary counting as one. Type or print all names beneath signatures to avoid a $1 penalty. Include the grantee mailing address or pay an extra $5 fee.

When transferring property with consideration over $2,000, you must file Form OP-236 with the deed. This form calculates state and local conveyance taxes. The clerk cannot record the deed without this form and payment. The state conveyance tax is 0.75% on the first $800,000 for residential property and 1.25% above that amount. Non-residential property pays 1.25% on the full value.

Electronic Recording

Windsor accepts electronic recording through four approved vendors: Simplifile, Corporation Service Company, eRecording Partners Network, and Indecomm Global Services. E-recording lets you submit documents online without visiting the office. The clerk processes submissions during business hours and returns recorded copies electronically the same day if everything is in order.

To use e-recording, register with one of the approved vendors. Upload your document as a PDF, pay fees online, and submit. The vendor validates formatting before transmission to the clerk. This speeds up real estate closings and eliminates trips to the clerk office. Fees remain the same as in-person recording.

Types of Land Records

The Windsor Town Clerk records several types of land documents:

- Warranty deeds and quitclaim deeds

- Mortgage deeds and assignments

- Releases and discharges

- Mechanic's liens and tax liens

- Lis pendens notices

- Easements and rights of way

- Maps and subdivision plats

All documents are indexed by grantor and grantee name. You can search either way to find property transfers. The clerk maintains both paper records in the vault and digital images for recent filings. Maps are indexed separately and show lot boundaries, easements, and subdivision layouts.

Conveyance Tax Information

Connecticut charges a conveyance tax on most property sales. The Department of Revenue Services collects this tax through town clerks. For residential property, the rate is 0.75% on the first $800,000 and 1.25% on amounts above that. Non-residential property and unimproved land have different rates. Windsor may also charge a local conveyance tax in addition to the state tax.

Form OP-236 must accompany all deeds with consideration over $2,000. The form shows the sale price, calculates the tax owed, and identifies the buyer and seller. The clerk collects the tax at recording and forwards it to DRS within ten days. Some transfers are exempt, such as gifts between family members or corrections of prior deeds. Check the form instructions or consult an attorney if unsure whether your transfer is taxable.

Legal Framework

Connecticut General Statutes Title 47 governs land records and conveyances. Recording your deed gives public notice of ownership and protects against later claims. An unrecorded deed is valid between buyer and seller but does not prevent someone else from filing a claim against the property. The Marketable Record Title Act in sections 47-33b through 47-33l establishes that a 40-year chain of title is sufficient for marketable title. This simplifies title searches by extinguishing old defects.

For title searches, research, or legal questions about property ownership, consult a real estate attorney or title company. The Windsor Town Clerk can provide copies of recorded documents but cannot give legal advice about their meaning or effect.

Note: Always verify which town has jurisdiction over a property before searching. Windsor records only cover land located within town boundaries.