Find Connecticut Deed Records

Connecticut deed records are maintained by town clerks in each of the state's 169 municipalities across eight counties. These land records include property deeds, mortgage documents, liens, easements, maps, and other real estate transactions. You can search deed records online through town portals, visit clerk offices in person, or request documents by mail. Most towns offer digital access to indexed land records dating back decades, while some maintain records from the 1700s in their original paper form.

Connecticut Deed Records Quick Facts

Where Connecticut Land Records Are Kept

Connecticut uses a town-based recording system. There are no county recorders in this state. Each town or city clerk maintains deed records for property located within that municipality. This means you must go to the specific town where the property sits to find its land records. Bridgeport keeps deeds for Bridgeport properties. Stamford maintains records for Stamford real estate. Hartford has its own land record books. Every one of Connecticut's 169 towns works the same way.

The town clerk office is where all land transactions get recorded in Connecticut. When someone buys a house, the deed goes to the town clerk. When a bank gives a mortgage, that document is filed with the clerk too. Liens, releases, easements, and property maps all end up in the town clerk's vault. These offices are open during business hours, typically from 8:30 AM to 4:00 PM on weekdays. Most clerks close for lunch or limit recording hours to earlier in the afternoon.

State law requires that deeds be recorded in the town where the land is located. Connecticut General Statutes Title 47, Chapter 821 sets the rules for how land records work in Connecticut. An unrecorded deed is valid between the buyer and seller but does not protect against other claims. Recording gives public notice that you own the property. It creates a legal record that anyone can search.

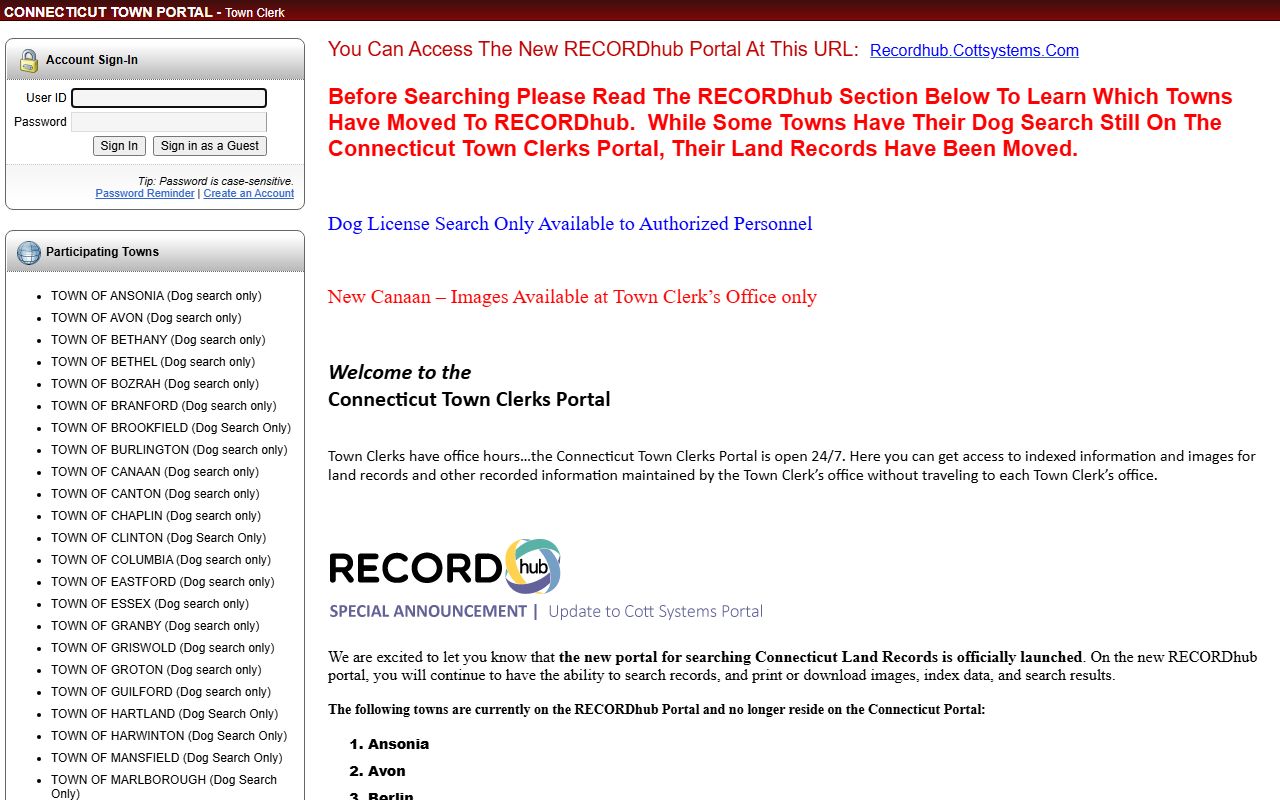

Many towns now offer online access to their land record indexes and images. The Connecticut Town Clerks Portal provides 24/7 access to records from over 70 participating municipalities. You can search by name, date, or document type. Images of actual recorded documents are available for recent years. Older records may have indexed information without scanned images. Some towns use different systems like RecordHub or US Land Records, but the concept is the same. You pick the town, then search its database.

Note: Always verify which town has jurisdiction over the property before searching for deed records in Connecticut.

How to Search for Deeds Online

Start by identifying the town where the property is located. Look at tax records or the property address to confirm the municipality. Once you know the town, visit that town clerk's website. Most have a link to their land records search portal. Some towns are part of the statewide Connecticut Town Clerks Portal. Others use private vendors like Cott Systems or Info Quick Solutions.

The US Land Records site offers a central entry point for many Connecticut towns. Select your town from the list, and it takes you to that municipality's search page. You can search by grantor name, grantee name, or document type. Enter the last name and first few letters of the first name. The system returns a list of matches. Click on a result to see details about that recorded document. Some towns let you view the full document image for free. Others charge a small fee to print or download pages.

RecordHub is another common platform used by Connecticut towns. Visit recordhub.cottsystems.com and choose your town. The interface lets you browse land record books or search by party name. Many RecordHub towns offer guest access for free viewing. If you need to print documents, you may need to create an account or pay per page. Search results show the book and page number where the document is recorded. You can also see the date, type of document, and parties involved.

Some Connecticut towns use the Info Quick Solutions system. For example, Hartford uses SearchIQS for its land records. The search works like other systems. Enter a name or document number. View the results. Click to see images if available. Each town sets its own fees for online access. Some are free. Some charge monthly or annual subscription fees. Others charge per page printed.

If a town does not have online records, you can still search in person at the clerk office. Call ahead to check their hours and whether they require an appointment. Staff can help you use the index books to find recorded documents. Most clerks have public computers for searching their database even if it is not available from home.

Fees for Recording and Copies

Connecticut law sets standard recording fees. As of July 1, 2025, town clerks charge $70 to record the first page of any document. Each additional page costs $5. So a three-page deed costs $80 to record. A ten-page mortgage costs $115. These fees are set by state statute and apply in every town.

Special fees apply to nominee documents like MERS. The first page of a MERS assignment or release costs $160 flat, with no extra fee for additional pages on those specific document types. Other MERS documents cost $160 for the first page and $5 for each extra page. Towns also charge a $2 surcharge on deeds with consideration over $2,000. This fee goes to the Department of Revenue Services for conveyance tax processing.

Copy fees are much lower. Town clerks charge $1 per page for copies of recorded documents. Certification adds $2 per document, not per page. So a certified copy of a five-page deed costs $7 total. Some towns charge extra if the grantee address is missing from a deed or if names are not typed under signatures. These penalties are $5 and $1 respectively under Connecticut General Statutes Section 7-34a.

Map filing costs $20 for most maps. Subdivision maps with three or more parcels cost $30. Online printing fees vary by town and vendor. Some towns let you view images for free but charge to print. Others require a subscription to access any images at all. Subscription costs range from $30 per month to $130 per year depending on the town and system used.

What Land Records Include

Deed records in Connecticut encompass many document types beyond just property deeds. A warranty deed transfers ownership with guarantees about the title. A quitclaim deed transfers whatever interest the grantor has, if any, without promises. Both are common in Connecticut land records. The town clerk records these along with mortgage deeds, which are the documents that create a lien when you borrow money to buy property.

Liens appear in land records too. A mechanic's lien filed by a contractor who did not get paid becomes part of the public record. Tax liens from the IRS or state show up in the land records. Judgment liens from court cases attach to property. All of these are recorded at the town clerk to give notice to anyone who searches the title.

Releases are recorded when a debt is paid off. A mortgage discharge releases the lien created by a mortgage deed. A lien release clears a mechanic's lien or judgment lien. These documents are important because they show that prior claims on the property have been satisfied. Title searches look for unreleased liens as potential problems.

Connecticut land records typically contain these document types:

- Warranty deeds and quitclaim deeds

- Mortgage deeds and assignments

- Releases and discharges

- Lis pendens notices

- Easements and rights of way

- Property maps and surveys

- Condominium documents

Maps and surveys are recorded to show property boundaries. Subdivision maps show how a large parcel was divided into lots. Site plans show where buildings sit on a lot. Easement maps display rights of way for utilities or access. These are all part of the land records maintained by town clerks in Connecticut.

Note: Trade name certificates and some military discharge papers are also recorded with town clerks, though these are not land records.

Real Estate Conveyance Tax

Connecticut charges a conveyance tax when property changes hands. This is a transfer tax paid to the state and often to the town as well. The state tax rate is 0.75% for residential property up to $800,000. For the amount over $800,000, the rate jumps to 1.25%. Non-residential property is taxed at 1.25% on the full amount. Unimproved land is 0.75% regardless of price.

Towns can add their own conveyance tax on top of the state tax. Many do. The local rate varies by municipality. Stamford charges 0.35% up to $999,999.99 and 0.50% above $1 million. Danbury charges 0.25%. Other towns have different rates or no local tax at all. You need to check the specific town to know the total tax owed.

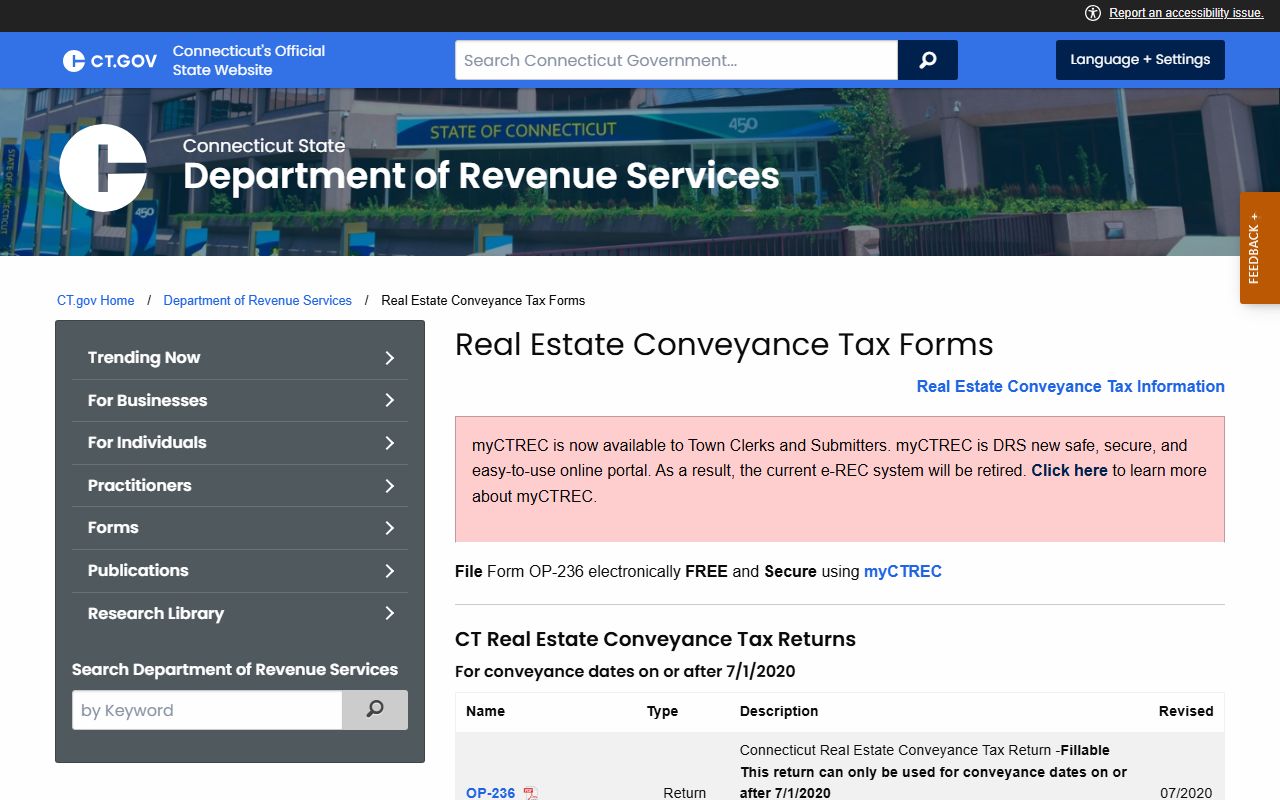

Form OP-236 is the Connecticut Real Estate Conveyance Tax Return. This form must be filed with the town clerk when recording any deed with consideration over $2,000. The form calculates the state and local tax owed. It includes information about the buyer, seller, property, and sale price. The grantor or their attorney typically prepares this form. Two copies go to the town clerk, who forwards one to the Department of Revenue Services. Payment must accompany the form when the deed is recorded.

Some transfers are exempt from conveyance tax. Gifts with no consideration do not trigger the tax. Transfers between spouses as part of a divorce are exempt. Transfers to correct an error in a prior deed may be exempt. The OP-236 form has boxes to check for various exemptions. Even if exempt, you still must file the form with the town clerk in Connecticut.

Electronic Recording in Connecticut

All Connecticut towns accept electronic recording. This lets attorneys, title companies, and lenders submit documents online instead of in person. E-recording is faster and more convenient. Documents can be filed from anywhere at any time. The town clerk receives the digital file, reviews it, and records it in the land records if everything is in order.

Four vendors provide e-recording services in Connecticut. Simplifile is one of the most widely used. Call them at (800) 460-5657 to set up an account. Corporation Service Company offers e-recording at erecording.com or by phone at (866) 652-0111. The eRecording Partners Network operates at (888) 325-3365. Indecomm Global Services can be reached at (651) 766-2350. All four work with every town in Connecticut.

E-recording does not change the recording fees. You still pay $70 for the first page and $5 for each extra page. The vendor may charge its own service fee on top of the town's recording fee. Check with your chosen vendor for their pricing. The town clerk sets recording hours for e-recording, often from 8:30 AM to 3:00 PM on business days. Documents submitted outside those hours are held until the next business day.

Not all document types can be e-recorded in some towns. For example, Branford does not accept OP-236 tax returns through e-recording. You would need to file those in person or by mail. Check with the specific town clerk if you are unsure whether your document type is accepted electronically.

Document Requirements for Recording

Connecticut law sets specific rules for how deeds must be prepared to be recordable. The document must be in writing, signed by the grantor, and acknowledged before a notary public. Two witnesses must attest to the signature, though the notary can serve as one witness. Names must be typed or printed beneath all signatures. The grantee's current mailing address must appear on the deed. These are all requirements under Connecticut statutes.

Format matters too. Use black ink only. Font size must be at least 10 points. Paper should be white, either 8.5 by 11 inches or 8.5 by 14 inches. Margins need to be clear for the clerk to stamp the recording information. Documents that do not meet these standards may be rejected by the town clerk in Connecticut.

The deed should include a legal description of the property. This can be a metes and bounds description, a reference to a prior recorded deed, or a lot number from a subdivision map. The description must be sufficient to identify the property. A street address alone is not enough. Connecticut title standards require a proper legal description for valid recording.

If you are recording a deed with consideration over $2,000, attach Form OP-236. This is the conveyance tax return. It must be filled out completely and signed. Include a check for the tax amount payable to the Commissioner of Revenue Services. The town clerk will not record the deed without the tax return and payment. Some deeds require Schedule A if there are more than two grantors or Schedule B if there is more than one grantee or an entity grantee.

Marketable Title in Connecticut

Connecticut uses a 40-year title search period. The Marketable Record Title Act creates marketable title when you have an unbroken chain of title for at least 40 years. This is found in Connecticut General Statutes Sections 47-33b through 47-33l. The root of title must be a document recorded at least 40 years before the search date. If the chain from that root document to the present is clean, the title is marketable under the act.

The purpose of this law is to clear old defects from land titles. Claims that arose before the 40-year root of title are automatically extinguished. You do not need to track down ancient heirs or cure title problems from a century ago. As long as the past 40 years show clear ownership, the title is good. This makes Connecticut real estate transactions more efficient.

There are exceptions to the 40-year rule. Easements that are still in use do not get extinguished. Mineral rights may survive even if not mentioned in recent deeds. Government interests in land are not affected by the marketable title act. But for most residential real estate, the 40-year search is sufficient to establish title in Connecticut.

Title companies and attorneys rely on this law when conducting title searches. They go back 40 years in the land records, checking every deed, mortgage, lien, and release. They look for breaks in the chain of ownership or unresolved claims. If the search comes back clean, the title company will issue insurance. If problems appear, they must be fixed before closing.

Browse Deed Records by County

Connecticut is divided into eight counties. Each county contains multiple towns, and each town maintains its own land records. Select a county below to see information about towns within that county and how to access their deed records.

View All 8 Connecticut Counties

Deed Records in Major Cities

Major Connecticut cities have their own town or city clerk offices that handle land records. These municipalities offer online search options and public access to deed records during business hours.