Search Bridgeport Deed Records

Bridgeport land records are kept by the Town Clerk at 45 Lyon Terrace. This is Connecticut's largest city, and the clerk files thousands of deeds each year. Property buyers and sellers must record their documents here to make them official. The office has an index that goes back to 1948, and images of deeds start from 1983. You can search these files online or visit in person. Maps are also on file, some dating to 1835. The clerk handles warranty deeds, quitclaim deeds, mortgages, and liens. All real estate deals in Bridgeport pass through this office. If you own land here, your deed is in their vault.

Bridgeport Overview

How to Access Bridgeport Deeds

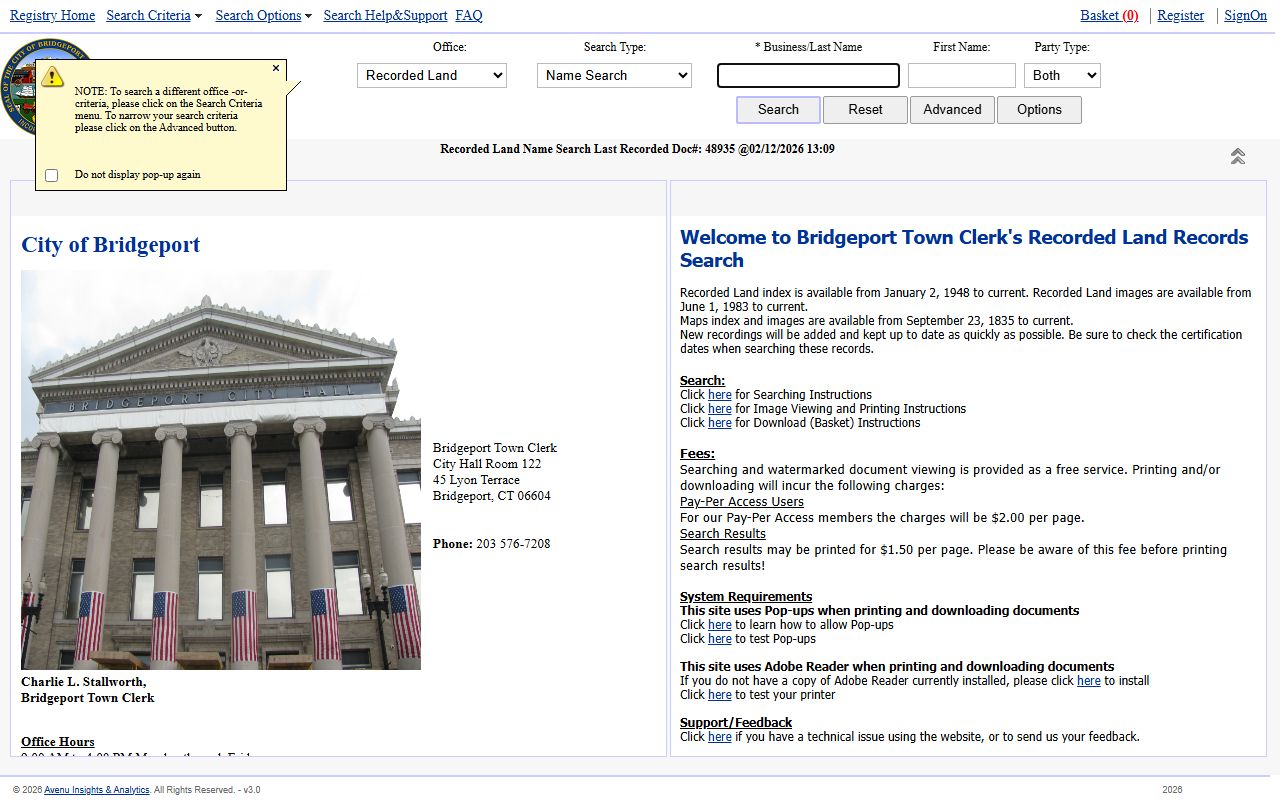

Bridgeport offers online access to land records through US Land Records. This database holds all recorded documents from June 1983 forward. The index goes back even further, to January 1948. You can search by name, date, or book and page number. The system is free to search and view. If you want to print or save documents, there may be a subscription fee. The clerk updates the database daily as new filings come in.

To use the online system, visit the land records page on the city website. From there, click the link to the search portal. You will see options for grantor, grantee, or document type. Enter the information you have and click search. Results show a list of matching records. Click on any entry to see the full document image. This is the same record kept in the clerk's vault.

The Bridgeport land records database includes not just deeds but also mortgages, releases, and liens. Maps and surveys are indexed separately. You can view these as well if you need to check property boundaries. The clerk's office can provide certified copies if you need them for legal use. Call ahead to confirm availability and fees.

Recording Fees and Requirements

Bridgeport follows state law for recording fees. As of July 1, 2025, the fee is $70 for the first page and $5 for each additional page. If the document involves a MERS nominee, the first page costs $160. Assignments and releases under MERS have a flat fee of $160. Copies cost $1 per page, and certification adds $2 per document. Maps are $20 to file, or $30 if the map shows a subdivision with three or more parcels.

Before you record a deed, make sure it meets all legal requirements. The document must be signed by the grantor and notarized. Two witnesses should also sign, and the notary can be one of them. Names must be typed or printed below each signature. The grantee's current mailing address must appear on the deed. If it is missing, you will pay an extra $5. Use black ink and white paper in standard size. These rules come from Connecticut General Statutes Title 47.

When property is sold, the seller must file Form OP-236 along with the deed. This form calculates the state and local conveyance tax. The clerk collects the tax and sends it to the Department of Revenue Services. Make sure the form is filled out correctly to avoid delays. If there are multiple grantors or grantees, attach the required schedules. The clerk cannot record the deed without the tax form.

E-Recording in Bridgeport

Bridgeport accepts electronic recording through several vendors. These include Simplifile, CSC, ePN, and Indecomm. E-recording lets you submit documents online without visiting the office. This is faster and more convenient, especially for title companies and attorneys. You must register with one of the approved vendors to use this service.

E-recording works for most types of documents, including deeds, mortgages, and releases. However, transactions that require Form OP-236 may not be eligible. Check with the vendor before submitting. The clerk processes e-recorded documents during business hours. You will receive a confirmation once the document is recorded. The recorded copy is sent back electronically with the official stamp.

Types of Documents Filed

The Town Clerk records many types of land documents. Warranty deeds are the most common for home sales. The seller promises that the title is clear and will defend it if challenged. Quitclaim deeds transfer ownership without any promises. These are often used between family members or to fix title problems. Mortgage deeds create a lien to secure a loan. When the loan is paid, a release of mortgage is filed to clear the lien.

Liens can be filed by contractors, tax authorities, or court judgments. They attach to the property and must be paid before the property can be sold. Easements give someone the right to use part of the land, such as for a road or utility line. All of these documents are public records. Anyone can search them to learn about property ownership or debts.

Conveyance Tax in Bridgeport

Bridgeport collects a local conveyance tax on property sales in addition to the state tax. The state rate is 0.75% on the first $800,000 of a residential sale, and 1.25% on amounts above that. Non-residential property is taxed at 1.25% on the full amount. The local rate is set by city ordinance and varies by property type. These taxes are paid by the seller at closing. The buyer does not pay conveyance tax but may pay other closing costs.

Form OP-236 is used to report the sale price and calculate the tax. The form has two copies: one for the town clerk and one for the state. Both must be submitted when the deed is recorded. The clerk forwards the state's copy to the Department of Revenue Services within ten days. If the form is incorrect or incomplete, the clerk will reject the filing. This can delay the closing of a real estate deal.

Historical Records and Maps

Bridgeport has a rich history, and its land records reflect that. The earliest maps on file date back to 1835. These old maps show how the city grew over time. They can be useful for research or to settle boundary disputes. The clerk's office has bound volumes of deeds going back many decades. Some of these have been scanned and are available online. Others must be viewed in person.

If you need a historical deed, start with the online index. It may point you to the right book and page. If the image is not online, visit the clerk's office during business hours. Staff can retrieve the volume and let you view it. Copies can be made for a small fee. Certified copies carry the official seal and can be used in court or for title searches.

Legal Authority and Statutes

Connecticut law requires all land conveyances to be recorded in the town where the property is located. CGS Section 47-10 states that unrecorded deeds are not valid against third parties. This means recording protects your ownership from later claims. The law also requires deeds to be acknowledged by a notary and witnessed by two people. These formalities ensure the deed is genuine.

The Marketable Record Title Act, found in CGS 47-33b through 47-33l, helps clear old defects in title. If a property has an unbroken chain of title for 40 years, earlier claims are extinguished. This makes it easier to sell property without extensive title searches. The act applies to most types of land in Connecticut. However, some exceptions exist, so consult an attorney if you have questions.

CGS Title 7 governs the duties and fees of town clerks. Section 7-34a sets the standard recording fees. It also allows for electronic recording if the town clerk chooses to accept it. Bridgeport has opted in to e-recording, which makes the process faster. The law also imposes penalties for documents that do not meet formatting requirements. Always check your paperwork before filing.

Fraud Prevention and Alerts

Property fraud is a growing concern. Criminals may forge deeds to steal ownership of homes. To protect yourself, monitor your property records regularly. Some towns offer free fraud alert services. These send you an email when a document is recorded under your name. While Bridgeport does not currently advertise this service, you can check the online database yourself from time to time.

If you suspect fraud, contact the Town Clerk and the police immediately. You may also need to consult an attorney to clear your title. Recording a corrective deed can sometimes fix the problem. In other cases, a court order may be needed. Keep copies of all your property documents in a safe place. This makes it easier to prove ownership if a dispute arises.

Nearby Cities and County Resources

Bridgeport is part of Fairfield County, which has no county-level land records. Each city and town in the county maintains its own system. Nearby cities include Fairfield, Stratford, and Norwalk. If you own property in more than one town, you must record deeds separately in each location. Stamford and Danbury also have busy land records offices with online access.

For statewide resources, visit the Connecticut Town Clerks Portal. This site links to over 70 towns and allows cross-town searching. You can also use US Land Records to access multiple towns. Both services are helpful if you are researching property across Connecticut. The Secretary of the State provides information on notaries and business filings.