Stamford Land Records

Stamford deed records are filed with the Town Clerk at 888 Washington Boulevard. As the second largest city in Connecticut with over 139,000 people, Stamford is in Fairfield County. All land records for property in Stamford go through the Town Clerk office. This includes deeds, mortgages, releases, liens, and maps. You can search land records in person at the clerk office or use online databases to find deed records from home. Connecticut law requires all deeds for Stamford property to be recorded with the Stamford Town Clerk.

Stamford Quick Facts

Stamford Town Clerk Office

The Stamford Town Clerk maintains all land records for the city. This is where you file new deeds and get copies of old ones. The clerk keeps records of all property transfers in Stamford. If you own land or a home in Stamford, your deed is on file here. The office is open to the public for land record searches during business hours. The land records vault has specific hours for public access.

| Office | Stamford Town Clerk |

|---|---|

| Address | 888 Washington Boulevard Stamford, CT 06901 |

| Phone | (203) 977-4054 |

| townclerk@stamfordct.gov | |

| Hours | Monday through Friday, 8:00 AM to 4:30 PM Vault: 8:00 AM to 3:30 PM |

| Website | stamfordct.gov |

You can walk in to search land records at the clerk office. Bring the name of a property owner or the street address. Staff will help you find the right book and page. Copies cost $1 per page. If you need a certified copy of a deed, add $2 for the seal. Most people who search deed records in Stamford want to check title before buying a home or to find out who owns a piece of land.

Stamford land records online date back to 1998. The city has a subscription-based service for 24/7 access. This makes it easy to find deed records in Stamford without going to city hall. The online system shows deed images and indexes.

How to Search Deed Records in Stamford

Stamford has its own online land records system at landrecords.cityofstamford.org. The site has records from 1998 to the present. You can search by name, date, or book and page number. The site shows full deed images. You need a subscription to print documents, but viewing is often free. This is the fastest way to find deed records in Stamford.

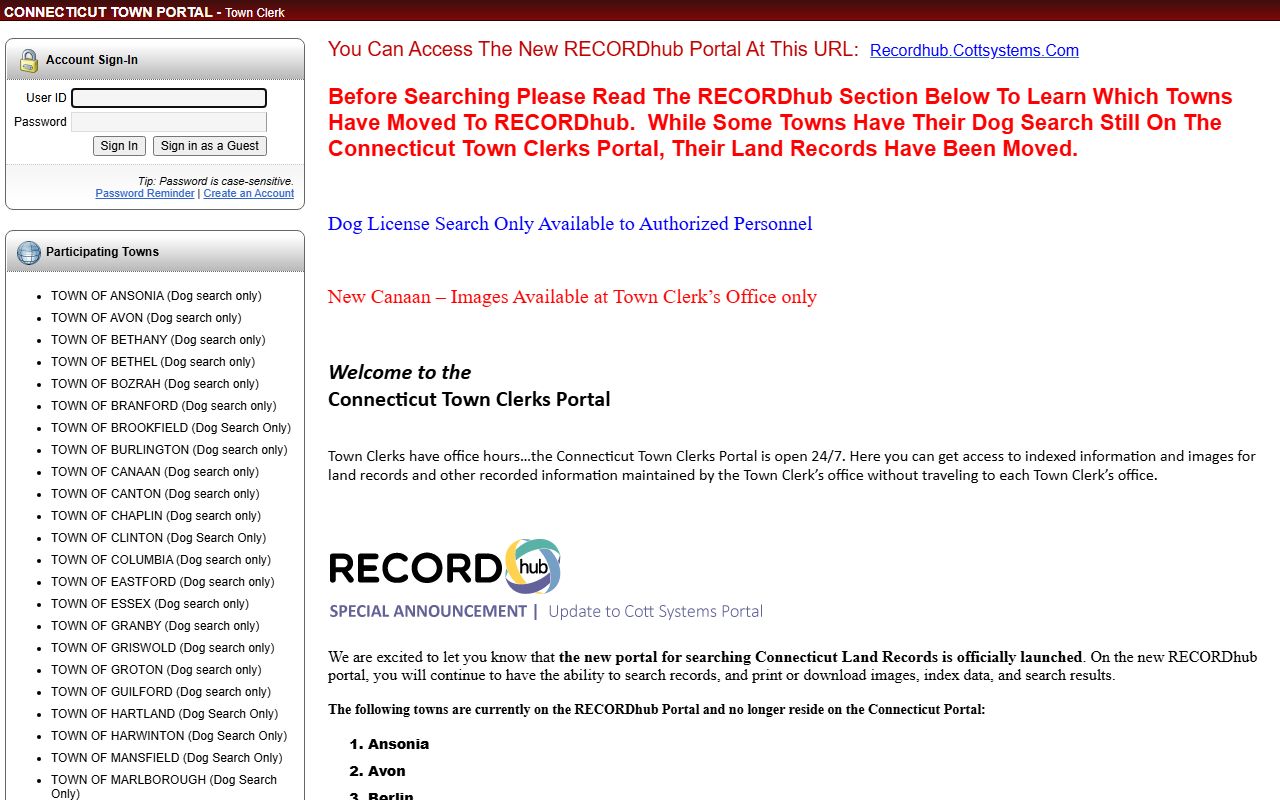

The Connecticut Town Clerks Portal also has Stamford land records. The site is open all day and night. You see the index with names and dates at no cost. If you want to print a deed image, you pay a small fee. This statewide portal makes it easy to search deed records across Connecticut, including Stamford.

You can also use US Land Records to search for Stamford deeds. Pick Stamford from the town list. Type in the grantor name or grantee name. A grantor is the one who sells or gives the land. A grantee is the one who gets it. This site shows you the book and page number for each deed. You can view images if you sign up for access.

To find a specific deed in Stamford, you need:

- Owner name or past owner name

- Street address of the property

- Year the deed was filed

- Book and page number if you know it

If you do not know the year, you can search by name. The index will show all deeds for that person in Stamford. This helps if you want to trace title or see how land changed hands over time.

Filing Deeds in Stamford

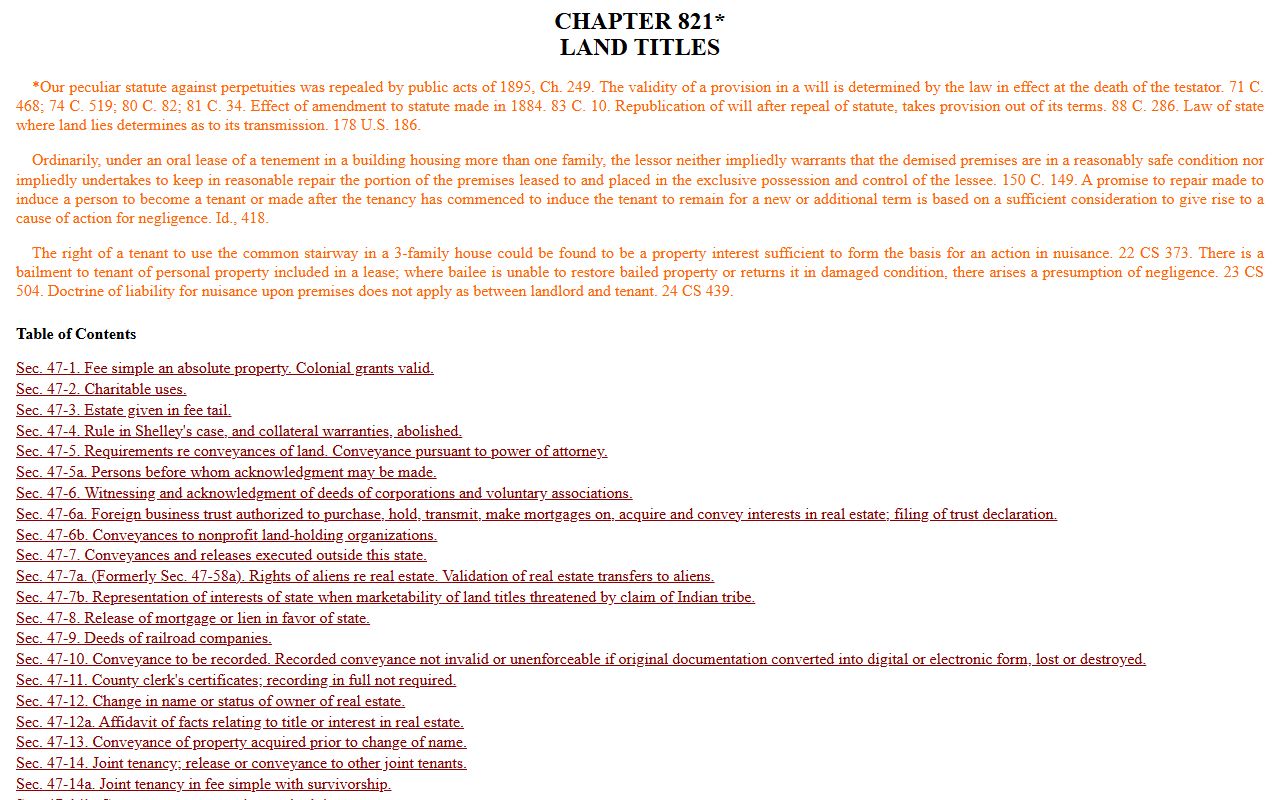

When you buy or sell land in Stamford, you must record the deed with the Town Clerk. Under Connecticut General Statutes Title 47, a deed must be filed in the town where the land sits. An unrecorded deed is valid between the buyer and seller, but it does not protect you from claims by others. Filing the deed gives public notice that you own the land in Stamford.

Recording fees in Stamford follow the state schedule set by law. As of July 1, 2025, the fee is $70 for the first page and $5 for each added page. If the deed has a MERS nominee, the first page costs $160. Nominee assignments and releases are a flat $160 fee. These fees apply to all towns in Connecticut. Check the Connecticut Statutes Chapter 92 for the full list of clerk fees.

You can file deeds in Stamford in person or use e-recording. E-recording lets you submit a deed online through one of four approved vendors. The Town Clerk accepts files from Simplifile, CSC, ePN, and Indecomm. You upload your deed as a PDF and pay the fee online. The clerk reviews it and records it the same day if it meets all the rules. This is faster than going to city hall in Stamford.

All deeds must meet state format rules. The deed must be on white paper, 8.5 by 11 inches or 8.5 by 14 inches. Use black ink and a font size of at least 10 points. The grantor must sign the deed and have their name printed below the signature. A notary must sign as well. You also need to show the grantee mailing address on the deed or you pay an extra $5. If you skip the printed names under signatures, you pay an extra $1. These small fees add up, so check your deed before you file it in Stamford.

Note: Stamford charges a conveyance surcharge of $2 for consideration over $2,000 in addition to state and city conveyance tax.

Conveyance Tax in Stamford

Stamford requires a conveyance tax on most property sales. This includes both a state tax and a city tax. The Connecticut Department of Revenue Services collects the state tax when you file a deed for a sale or transfer with a price over $2,000. You must submit Form OP-236 along with the deed to the Town Clerk in Stamford. The clerk forwards the tax form to the state within 10 days.

Tax rates for Stamford are:

- State: 0.75% for homes up to $800,000

- State: 1.25% on amounts over $800,000 for homes

- State: 1.25% for commercial property and land

- City: 0.35% up to $999,999.99

- City: 0.50% for $1,000,000 and above

Stamford has one of the higher local conveyance tax rates in Fairfield County. This tax helps fund city services. Some transfers are exempt from the tax, such as gifts between family or deeds with no money changing hands. The tax form has a list of exempt transfers. If you think you are exempt, you still file the form but mark the exemption box.

You can file the conveyance tax form online through the myCTREC portal. This is the state system for real estate conveyance tax. You fill out Form OP-236 on the site and pay the tax by credit card or e-check. Once done, you print the form and bring it to the Stamford Town Clerk with your deed. The clerk will not record a deed without the tax form if the sale price is over $2,000.

Types of Deed Records in Stamford

The Stamford Town Clerk keeps many types of land records. Deeds are the most common. A warranty deed is used when you buy a home. A quitclaim deed is used to transfer land without a sale, like between family. Each type of deed gets filed the same way in Stamford, but the legal effect is different.

Other land records in Stamford include:

- Mortgage deeds that create a lien on the property

- Releases that remove a mortgage or lien

- Easements that give rights to use land

- Attachments and judgments that put a claim on land

- Maps and surveys that show lot lines

- Affidavits about title issues

All these records are indexed by grantor and grantee name. That means you can search by the name of the person who gave the land or the person who got it. This helps trace the chain of title in Stamford. A chain of title shows every owner from the first deed to the current one. Most title searches in Connecticut go back 40 years under the Marketable Record Title Act.

Maps and surveys have their own filing fee. In Stamford, a map with two parcels or less costs $20 to file. A subdivision map with three or more parcels costs $30. The clerk keeps a separate index for maps so you can find them by subdivision name or lot number. Maps help you see the exact size and shape of land in Stamford.

Fairfield County Deed Records

Stamford is in Fairfield County. All land records for Stamford are filed with the Stamford Town Clerk, not at a county office. Connecticut does not have county recording. Each town keeps its own land records. For more on how Fairfield County land records work, see the county page with links to all 23 towns in the county.

Nearby Cities in Connecticut

Other cities near Stamford with their own land records include Norwalk, Greenwich, Darien, and New Canaan. Each town in Connecticut keeps separate deed records. If you own land in more than one town, you file deeds in each place where the land sits.