New Haven County Land Records

New Haven County maintains property and deed records through individual town clerk offices in each of its 27 municipalities. There is no central county recording office. If you need to search for deed records, examine property titles, or obtain copies of land documents, you must contact the town clerk where the property sits. This decentralized system means each municipality keeps its own database and has unique procedures for accessing records. Connecticut law requires all conveyances to be recorded at the town level to provide notice and protect property rights. Many towns offer online search options through shared platforms like SearchIQS, RecordHub, and the statewide portal at connecticut-townclerks-records.com. You can access these records to research ownership, verify transactions, and obtain documentation.

New Haven County Quick Facts

Town Clerk Offices in New Haven County

Connecticut law directs all land records to town clerks. No county offices handle deed recording. You must file or search for documents in the specific town where the land is located. Each town clerk office has authority to record deeds, mortgages, liens, releases, easements, and other instruments affecting real property within that municipality.

New Haven County's 27 towns vary widely in size and resources. Major cities like New Haven, Waterbury, and Meriden handle thousands of recordings annually and maintain robust online databases. Smaller towns may have limited hours or require in-person visits for certain searches. Understanding which town covers your property is the first step. Once you know the town, contact that clerk directly or use their online portal if available.

New Haven City Clerk Office

The New Haven City Clerk handles all land records for properties in the city. The office is at 200 Orange Street, Room 202, New Haven, CT 06510. Phone is (203) 946-8339. Office hours run Monday through Friday from 9 AM to 5 PM. Recording hours end at 4 PM each day.

New Haven's database is online at www.searchiqs.com/ctnha. The system is free to search but requires a subscription for printing or viewing full document images. The clerk records mortgages, releases, quit claims, liens, notaries, justice commissions, dog licenses, liquor permits, trade name certificates, and alderpersons legislation. The office also manages city contracts, tax liens, and sewer liens. New Haven offers a land records fraud alert service where property owners can sign up for email notifications when documents are recorded under their name.

Waterbury Town Clerk Records

Waterbury is the second largest city in New Haven County. The Town Clerk Office sits at 235 Grand Street, 1st Floor, Waterbury, CT 06702. Phone is (203) 574-6806. Fax is (203) 574-6887. Land records are available through an IQS platform database maintained by New Vision Systems.

The Waterbury database provides online access to land record indexes and allows subscribers to view full images. The system goes down briefly for maintenance each day from midnight to 1 AM. Recording fees are $70 for the first page and $5 for each additional page. Nominee documents like MERS filings cost $160 for the first page. Surcharges include $2 for each transfer reportable to the state, $5 if the grantee address is missing, $1 if names are not typed under signatures, and $2 for assignments subsequent to the first two.

Waterbury charges conveyance tax at both state and city levels. The state rate is 0.75 percent for residential properties up to $800,000 and 1.25 percent for amounts over $800,000. The city rate is 0.5 percent. Map filing costs $20 for any map and $30 for subdivision maps. Document copies are $1 per page. Map copies cost $3. Certification adds $2. The town accepts e-recording through CSC, ePN, Indecomm, and Simplifile.

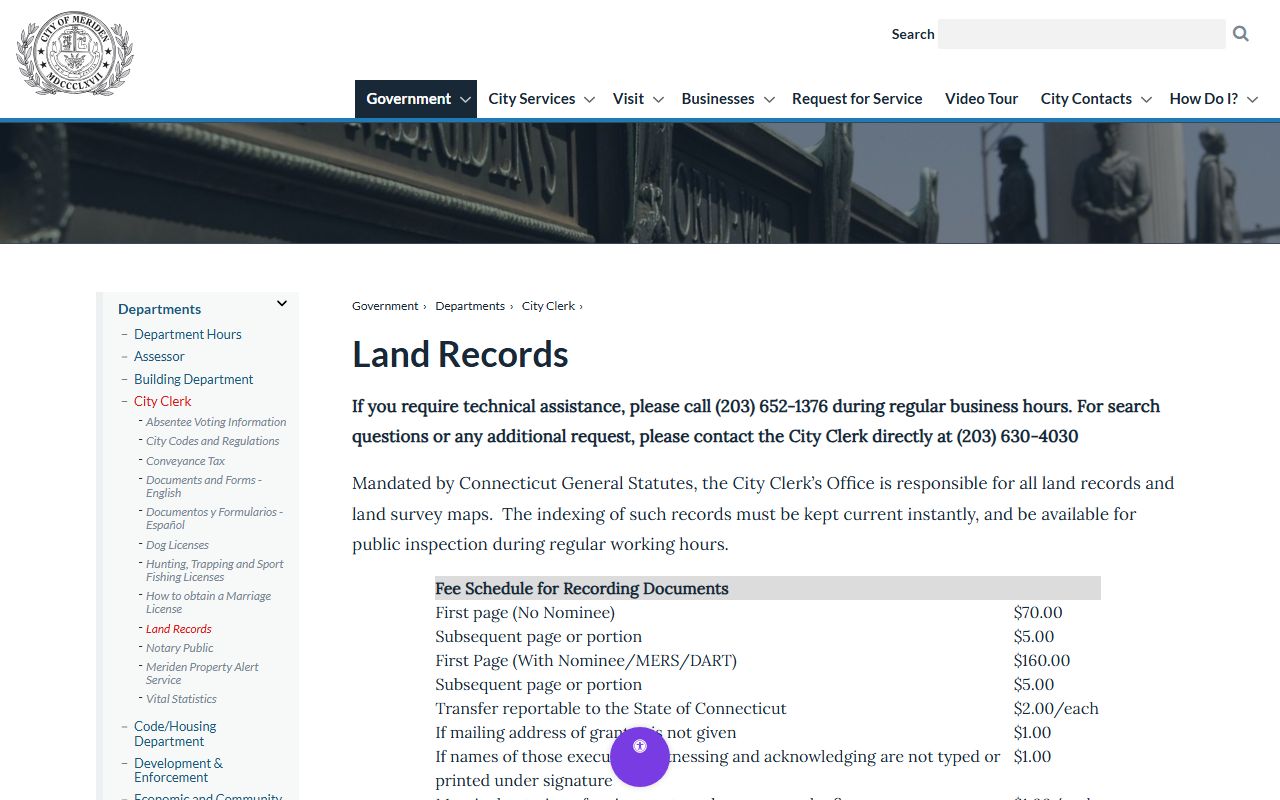

Meriden City Clerk Land Records

Meriden maintains land records and land survey maps at the City Clerk Office located at 142 East Main Street, Meriden, CT 06450. You can reach them at (203) 630-4125. The city clerk's land records page provides information and links to the online database at webhost01.newvisionsystems.com/MeridenSearch.

Meriden offers a free property alert service. Residents can sign up to receive email notifications when any document gets recorded under their name. This helps detect fraudulent activity and keeps owners informed about transactions affecting their property. The service is voluntary but recommended for anyone who owns real estate in Meriden.

Hamden Town Records

The Hamden Town Clerk Office is at 2750 Dixwell Avenue, Hamden, CT 06518. Phone is (203) 287-7110. Hamden uses the IQS Land Records Management System for online access. Recording fees are $70 for the first page and $5 for each additional page. Nominee documents cost $160 for the first page.

Hamden also participates in the IQS Property Fraud Alert program. Property owners can register to receive email alerts when documents are recorded under their name. The office cannot provide title information over the telephone. Staff cannot notarize land documents to be recorded in Hamden and cannot prepare legal documents. The office does not perform professional title searching. Residents must consult attorneys or title companies for those services.

Available records include property transfers in warranty deeds and quitclaim deeds. You can also find mortgage deeds, liens, easements, and condominium documents. The office maintains maps including subdivision plats, site plans, and easement maps. All of these are permanent records.

West Haven Recording Procedures

West Haven's Town Clerk Office is at 355 Main Street, West Haven, CT 06516. Phone is (203) 937-3510. The city website is www.cityofwesthaven.com. West Haven follows standard Connecticut procedures for recording deeds and other land instruments.

All documents must be submitted to the town clerk with appropriate recording fees. The clerk staff examines documents for compliance with state requirements before accepting them for filing. Once approved, documents are stamped with the date and time of receipt and assigned a book and page number. This creates the official record. Documents become effective as of the date of delivery to the town clerk.

Milford Land Records Access

Milford's Town Clerk Office is at 110 River Street, Milford, CT 06460. Phone is (203) 783-3210. The city website is www.ci.milford.ct.us. Milford maintains land records and provides search access through the town clerk's office and online portals.

Milford property owners should verify which online platform the city uses. Some New Haven County towns use the Connecticut Town Clerks Portal. Others use RecordHub or SearchIQS. Calling the clerk's office is the fastest way to confirm the correct search portal and determine whether a subscription is required for full document access.

Electronic Recording Options

Most New Haven County towns accept electronic recording. This allows attorneys, title companies, and lenders to submit documents digitally instead of appearing in person. Connecticut towns work with four approved e-recording vendors.

Simplifile can be reached at (800) 460-5657. Corporation Service Company operates at (866) 652-0111 with a website at www.erecording.com. eRecording Partners Network is available at (888) 325-3365 or www.erecordingpartners.net. Indecomm Global Services uses (651) 766-2350 or (612) 269-5452 with email at Vijay.sai@indecomm.net.

E-recording submissions must still meet all statutory requirements. Documents need proper signatures, notarization, witness attestation, and grantee addresses. The digital submission process simply replaces the physical delivery of paper to the town clerk. Recording fees remain the same. Towns typically process e-recordings faster than paper filings because the workflow is automated.

Recording Fees and Surcharges

Connecticut General Statutes Section 7-34a sets the base recording fees. As of July 1, 2025, under Public Act 25-168, the standard fee is $70 for the first page and $5 for each subsequent page. This applies across all New Haven County towns.

Additional surcharges apply in certain situations. If a deed involves consideration over $2,000, the town clerk adds a $2 surcharge for processing the Real Estate Conveyance Tax Return. If the grantee address is missing from the deed, add $5. If names are not printed under signatures, add $1. These fees are statutory and cannot be waived.

Nominee recordings like MERS documents cost more. The first page fee is $160. For MERS assignments and releases, this is a flat fee with no additional charges for extra pages. For other MERS documents, additional pages cost $5 each. Map filing costs $20. Subdivision maps with three or more parcels cost $30. Copy fees are $1 per page. Certification adds $2 per document.

Conveyance Tax Requirements

Connecticut law requires a Real Estate Conveyance Tax Return for all property transfers with consideration over $2,000. The form is OP-236. It must be submitted to the town clerk along with the deed. The clerk forwards the form and payment to the Department of Revenue Services within 10 days of recording.

The state conveyance tax rate is 0.75 percent for residential property valued up to $800,000. For the portion above $800,000, the rate is 1.25 percent. Non-residential property uses 1.25 percent for the full amount. Unimproved land uses 0.75 percent. Many New Haven County towns also impose local conveyance taxes. Rates vary by municipality. Waterbury charges 0.5 percent. Other towns may charge between 0.25 percent and 0.5 percent. You should verify the local rate with the town clerk before closing a transaction.

The OP-236 form requires detailed information about the transaction. You must list all grantors and grantees, the property address, the consideration amount, and the property type. If there are more than two grantors, you must attach Schedule A. If there is more than one grantee or a grantee is an entity, you must attach Schedule B. The form must be completed accurately and signed under penalty of false statement.

Document Preparation Standards

All deeds and land instruments recorded in New Haven County must meet statutory requirements under Connecticut General Statutes Sections 47-5 and 47-36c. Documents must be in writing and signed by the grantor. Printed or typed names must appear beneath all signatures. The grantor must acknowledge the document before a notary public. Two witnesses must attest the document, and the notary can serve as one witness.

The current mailing address of the grantee must appear on the deed. This is required by law and cannot be omitted. If it is missing, the clerk will still record the document but will add a $5 surcharge. Documents must be prepared in black ink using a minimum 10-point font. Paper size must be either 8.5 inches by 11 inches or 8.5 inches by 14 inches. The paper must be white.

Town clerks cannot provide blank forms or prepare legal documents. They cannot give title information or legal advice. Documents should be prepared by an attorney familiar with Connecticut real estate law. Errors in document preparation can affect title quality and cause delays in recording.

Connecticut Statutes Governing Land Records

Connecticut General Statutes Title 47 addresses land and land titles. Chapter 821 contains the core statutes. Section 47-10 states that no conveyance is effective against third parties unless recorded in the town where the land is located. This is the foundation of the recording system. Unrecorded deeds may be valid between the parties but do not provide constructive notice to the world.

The statutes in Chapter 821 also establish requirements for acknowledgments, witnesses, and document formats. Section 47-12a permits town clerks to record affidavits relating to title or interest in real estate. Sections 47-33b through 47-33l create the Marketable Record Title Act. This law allows property owners to establish marketable title with an unbroken chain for 40 years or more. The root of title must be recorded at least 40 years before the current date. This automatically extinguishes defects, claims, and interests arising before the root of title.

Title 7 governs town clerks. Chapter 92 sets out their duties and powers. Section 7-34a establishes recording fees and copy charges. Section 7-35ee allows town clerks to accept electronic documents for recording if they choose to participate in e-recording programs. Most Connecticut towns have adopted e-recording due to efficiency and convenience.

Online Search Portals

Several statewide and regional platforms provide online access to New Haven County land records. The Connecticut Town Clerks Portal at connecticut-townclerks-records.com covers over 70 cities and towns. It offers 24/7 access to indexed information and scanned images. The portal is subscription-based but provides guest access for basic searches.

US Land Records at www.uslandrecords.com/ctlr allows users to select individual towns for searches. RecordHub at recordhub.cottsystems.com serves many Connecticut municipalities. SearchIQS also provides access to multiple town databases. Each platform has its own fee structure and user interface. Some charge monthly subscriptions. Others charge per-page viewing or printing fees. Guest access is often free for searching indexes but requires payment to view full documents.

Copies and Certifications

You can obtain copies of recorded documents at any town clerk's office in New Haven County. The standard copy fee is $1 per page. If you need a certified copy, the clerk adds $2 per document. Certified copies include an official seal and signature from the town clerk attesting that the copy is a true and accurate reproduction of the original on file.

Certified copies are often required for legal proceedings, refinancing, and title insurance purposes. Uncertified copies are sufficient for research or personal records. Many online portals allow printing of documents for a per-page fee. These printed images are not certified and do not carry the same legal weight as certified copies from the clerk's office.

Historical Records and Archives

New Haven County towns maintain land records dating back to the colonial period. Some towns have records from the early 1700s. Many older records have been microfilmed or digitized to preserve them and improve access. The availability of historical records online varies by town. Larger municipalities have typically invested more in scanning older volumes.

If you need to research very old deeds or establish a long chain of title, you may need to visit the town clerk's office in person. Some clerks maintain index books that are not available online. These handwritten indexes can be essential for tracing ownership back more than 40 years. Staff can assist with locating books and pages, but they cannot perform title searches or interpret legal documents.

Legal Aid and Resources

Connecticut Legal Services provides free civil legal assistance to eligible low-income residents. The organization can help with property issues, foreclosure defense, and other real estate matters. Statewide Legal Services of Connecticut operates a hotline at 1-800-453-3320. The Connecticut Judicial Branch also provides self-help resources and forms for individuals representing themselves in court.

The Connecticut Bar Association offers a lawyer referral service for those who need private counsel. The State Library in Hartford maintains historical land records and can assist with genealogical and property research. The Connecticut Secretary of the State handles business entity filings, notary commissions, and authentications that may be related to real estate transactions.

Major Cities in New Haven County

New Haven County includes several cities with populations over 25,000. These cities maintain their own town clerk offices and land record systems.

- New Haven is the county seat and home to Yale University. It is the third largest city in Connecticut.

- Waterbury is known as the Brass City and is the fifth largest city in the state.

- Hamden borders New Haven to the north and has a population over 61,000.

- Meriden sits in the geographic center of Connecticut and maintains extensive land records.

- West Haven is located on Long Island Sound with beaches and coastal properties.

- Milford is a shoreline community with a historic downtown and diverse property types.

- Wallingford is home to residential neighborhoods and commercial districts.

- Naugatuck is in the Naugatuck River Valley with industrial and residential properties.

- Cheshire is a suburban town with strong residential development.

- Branford is a coastal town with shoreline properties and historical districts.

- East Haven borders New Haven to the east and has beach access.

Nearby Counties

New Haven County borders several other Connecticut counties. If your property search extends beyond New Haven County, you may need to contact clerks in neighboring areas.

Hartford County is to the north. It includes the state capital and many suburban towns. Middlesex County lies to the east along the Connecticut River. Fairfield County is to the west and southwest. It borders New York State and includes wealthy coastal towns. Litchfield County is to the northwest with rural and historic properties.