Deed Records in Naugatuck

Naugatuck maintains land records through the Town Clerk, who keeps all deed documents for property in the town. Each deed filed creates a permanent record of ownership. The office handles transfers, mortgages, liens, and other land documents. Searches can be done in person or online through the statewide portal. Most records date back decades, with older documents stored in archives. To search Naugatuck deed records, you can visit the clerk or use web access. Property buyers and title companies use these records to verify ownership and check for liens or claims before any sale.

Naugatuck Quick Facts

New Haven County Recording Office

Naugatuck land records are not kept at the county. Connecticut does not have county recording. All deed records get filed in the town where the land sits. This means you go to Naugatuck for any property in town limits. The New Haven County system has no central land records office. Each of the 27 towns runs its own system.

The town clerk receives all documents. Staff reviews them for proper notarization and form. They check that grantee names are typed, not just signed. If the address is missing, a five dollar fee applies. Once approved, the clerk stamps the date and time. The document gets a book and page number. This creates the official record.

Finding Property Records Online

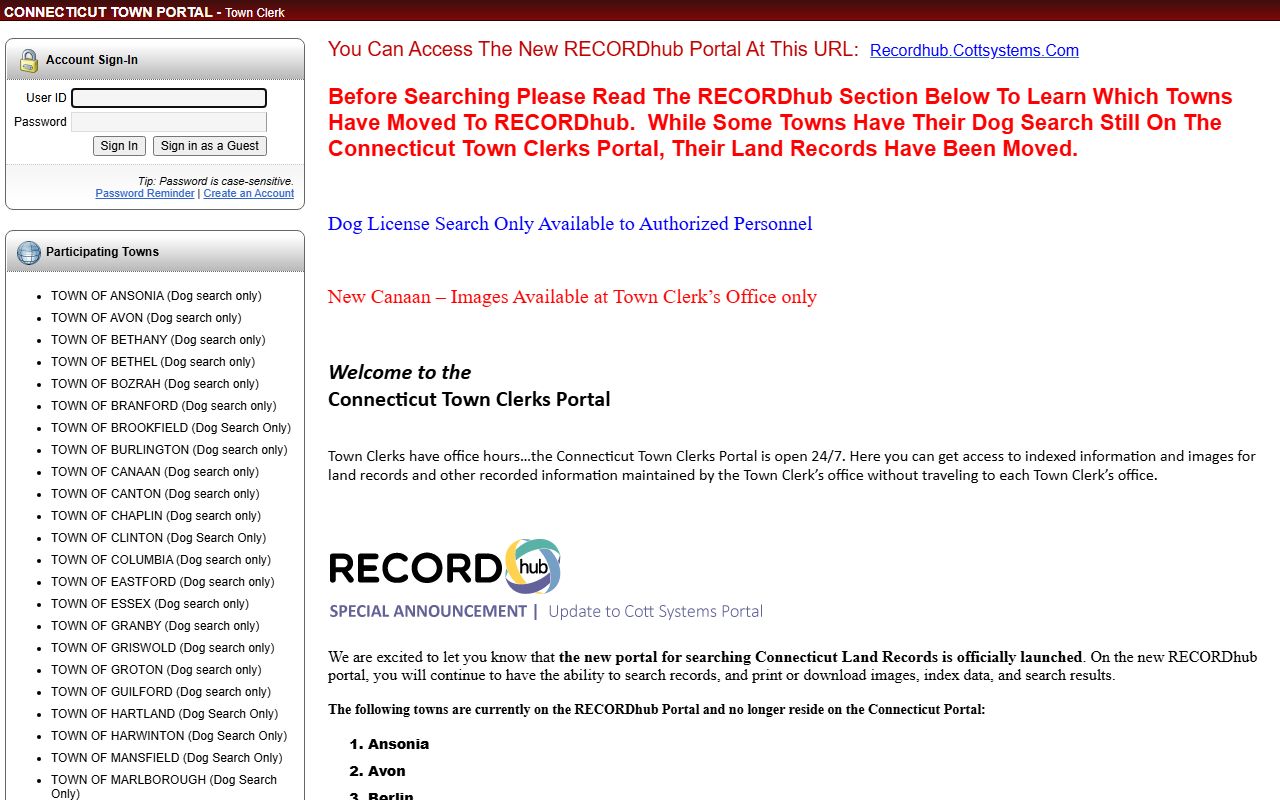

Naugatuck participates in the Connecticut Town Clerks Portal, which offers 24/7 access to land record images and indexes. You can search by name, address, or volume and page. The portal shows scanned copies of actual recorded documents. Most Naugatuck records from recent decades are available online.

Some searches are free. Viewing and printing require a subscription. The town uses this platform to make records accessible beyond office hours. You can also search through RecordHub or US Land Records for Connecticut towns. These sites charge fees but let you search multiple towns at once.

Recording Fees and Requirements

Recording a deed in Naugatuck costs $70 for the first page. Each additional page adds five dollars. If the document names a nominee like MERS, the first page fee jumps to $160. A two dollar surcharge applies when the conveyance value tops $2,000. Missing a grantee address costs an extra five dollars. Names must be typed under all signatures or add one dollar.

All documents need proper notarization. The grantor signs in front of a notary. Two witnesses must attest, and the notary can count as one. Documents must use black ink and at least ten point font. White paper only, either letter or legal size. The grantee address must appear on the deed. These rules come from Connecticut General Statutes Title 47.

Any deed transferring property for more than $2,000 requires Form OP-236, the Real Estate Conveyance Tax Return. You file this with the deed. The town forwards it to the state within ten days.

What Deed Records Show

A Naugatuck deed record contains several key pieces of information:

- Grantor name (seller) and address

- Grantee name (buyer) and address

- Legal description of the property

- Sale price or stated consideration

- Date of transfer and recording date

- Notary acknowledgment and witness signatures

- Book and page number for the recorded document

Mortgages also get recorded. They show lender name, borrower, loan amount, and the property pledged as security. Releases of mortgage prove the loan was paid off. Liens from contractors, tax authorities, or judgment creditors also appear in land records. These documents protect third parties by giving public notice of claims.

Title Search and Chain of Ownership

Connecticut follows the Marketable Record Title Act under CGS Sec. 47-33b through 47-33l. This law requires a 40-year chain of title. Title searchers look back four decades to find the root of title. Any defects or claims older than that are extinguished. This makes it easier to establish clear ownership.

Most title companies and real estate attorneys perform these searches before a sale. They review all deeds, mortgages, liens, and other recorded documents. The search reveals who owns the property and whether any claims exist. Buyers need clean title to get financing and insurance.

Note: Unrecorded deeds are valid between the parties but do not provide notice to others. Recording protects your interest against later buyers or creditors.

Electronic Recording Options

Naugatuck accepts electronic recording through approved vendors. These include Simplifile, Corporation Service Company, eRecording Partners Network, and Indecomm Global Services. Attorneys and lenders can upload documents directly. The system checks formatting and completeness. Once approved, the town clerk records the document electronically.

E-recording saves time. No trip to the office is needed. Documents can be submitted after hours. The clerk processes them during business hours. Most e-recordings get completed within one business day. This speeds up real estate closings and loan transactions.

Accessing Records in Person

You can visit the Naugatuck Town Clerk office to search deed records. Staff can help locate documents if you have a name, address, or book and page reference. The office has index books organized by grantor and grantee. You look up the name to find the volume and page number.

Copies cost one dollar per page. Certified copies add two dollars per document. The clerk can certify that a copy is a true reproduction of the original. Courts and other agencies often require certified copies.

Conveyance Tax Information

Connecticut charges a state conveyance tax on property sales. For residential property up to $800,000, the rate is 0.75 percent. Amounts over $800,000 pay 1.25 percent on the excess. Non-residential property pays 1.25 percent on the full amount. Naugatuck may also impose a local conveyance tax. Check with the town clerk for the current local rate.

The Department of Revenue Services collects these taxes through Form OP-236. The form must be completed and submitted with payment when you record a deed. The town clerk will not record a deed without the required tax return for taxable transfers.

Related Records and Resources

The Naugatuck Town Clerk also maintains other records that may relate to property:

- Maps and surveys showing lot boundaries

- Subdivision plats filed by developers

- Trade names and business certificates

- Military discharge records (DD-214)

- Federal tax liens

For court records related to property disputes or foreclosures, contact the Connecticut Judicial Branch. The Superior Court handles foreclosure actions, partition suits, and other real estate litigation. These records are separate from land records but may reference recorded documents.

Nearby Cities and Towns

If you need to search deed records in other New Haven County locations, the following cities also maintain their own land records:

Each town has its own clerk and recording system. There is no central office for New Haven County. You must go to the specific town where the property is located.