Meriden Deed Records Online

Meriden deed records are kept by the City Clerk at 142 East Main Street. Connecticut does not use county recording. All land documents for Meriden property are filed only in Meriden, not at New Haven County offices. You can search these records online or visit the clerk in person. The office handles deeds, mortgages, releases, liens, easements, and land survey maps. Meriden offers a free Property Alert Service that sends you email notifications when documents are recorded under your name. This helps detect fraud early. Online access is available 24 hours a day through New Vision Systems.

Meriden City Clerk Office

The Meriden City Clerk manages all deed recordings for properties located in Meriden. This office is part of New Haven County, but it operates independently for land records. There is no county recorder in Connecticut. Each of the state's 169 towns and cities keeps its own land records. The Meriden City Clerk is located at 142 East Main Street. Staff can help you search for documents, explain recording procedures, and answer questions about fees. You can also use electronic recording services to submit documents without visiting the office.

Office hours run Monday through Friday during standard business hours. If you plan to record a document in person, bring it before closing time. Most clerks stop accepting land records about 15 minutes before the office closes. E-recording is available all day through approved vendors like Simplifile, CSC, and ePN. These systems let you upload your deed or mortgage, pay the fee online, and receive a recorded copy by email. The clerk reviews each submission and either records it or rejects it with an explanation.

Address: 142 East Main Street, Meriden, CT 06450

Phone: (203) 630-4125

Website: meridenct.gov

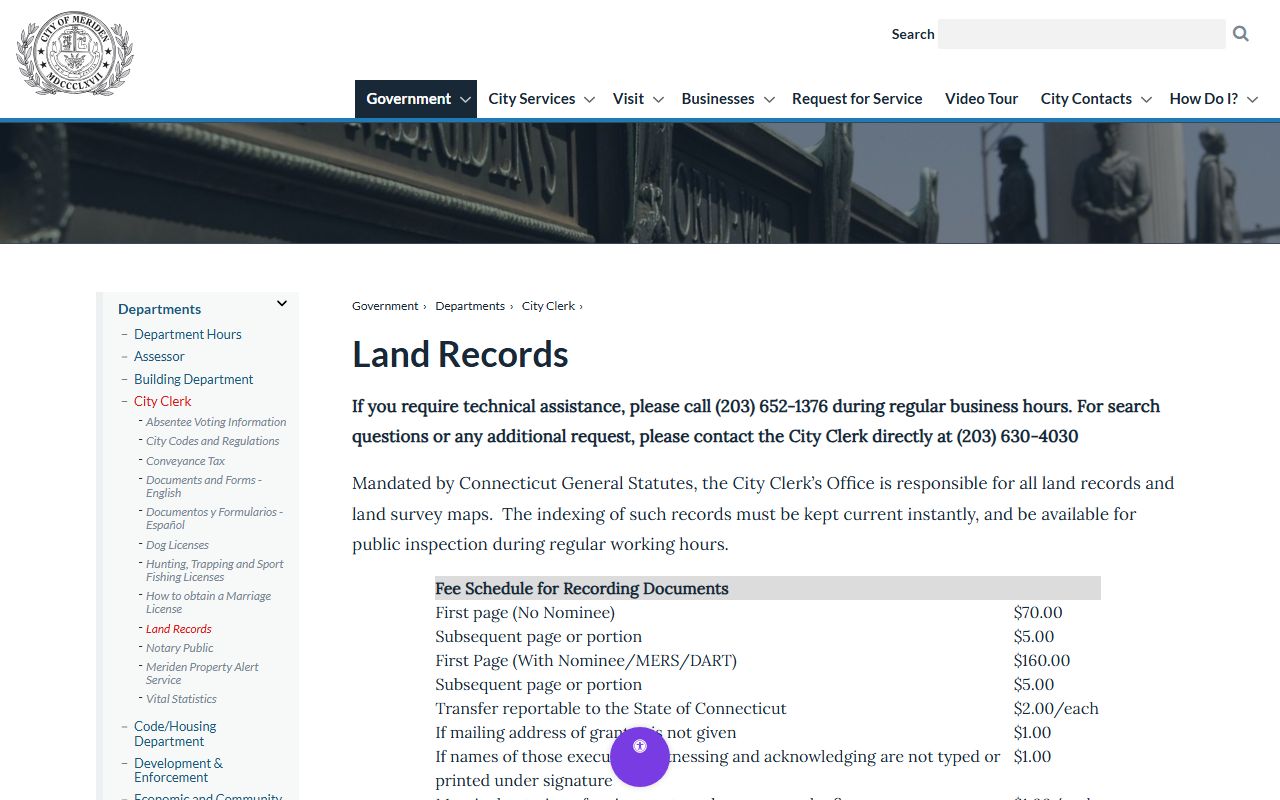

The Meriden City Clerk land records page provides information about recording procedures, fees, and online access. The image above shows this webpage, where you can find details about the online search system and the free Property Alert Service. Meriden uses New Vision Systems for online access to land records and land survey maps.

Searching Meriden Land Records

Meriden land records can be searched online through New Vision Systems. This system is free to search. You can look up names, addresses, book and page numbers, and document types. The portal displays indexed information and lets you view images of recorded documents. If you want to print or save images, you may need to purchase a subscription. Subscriptions vary in price, but most towns charge around $30 for one month or $100 to $130 for a full year.

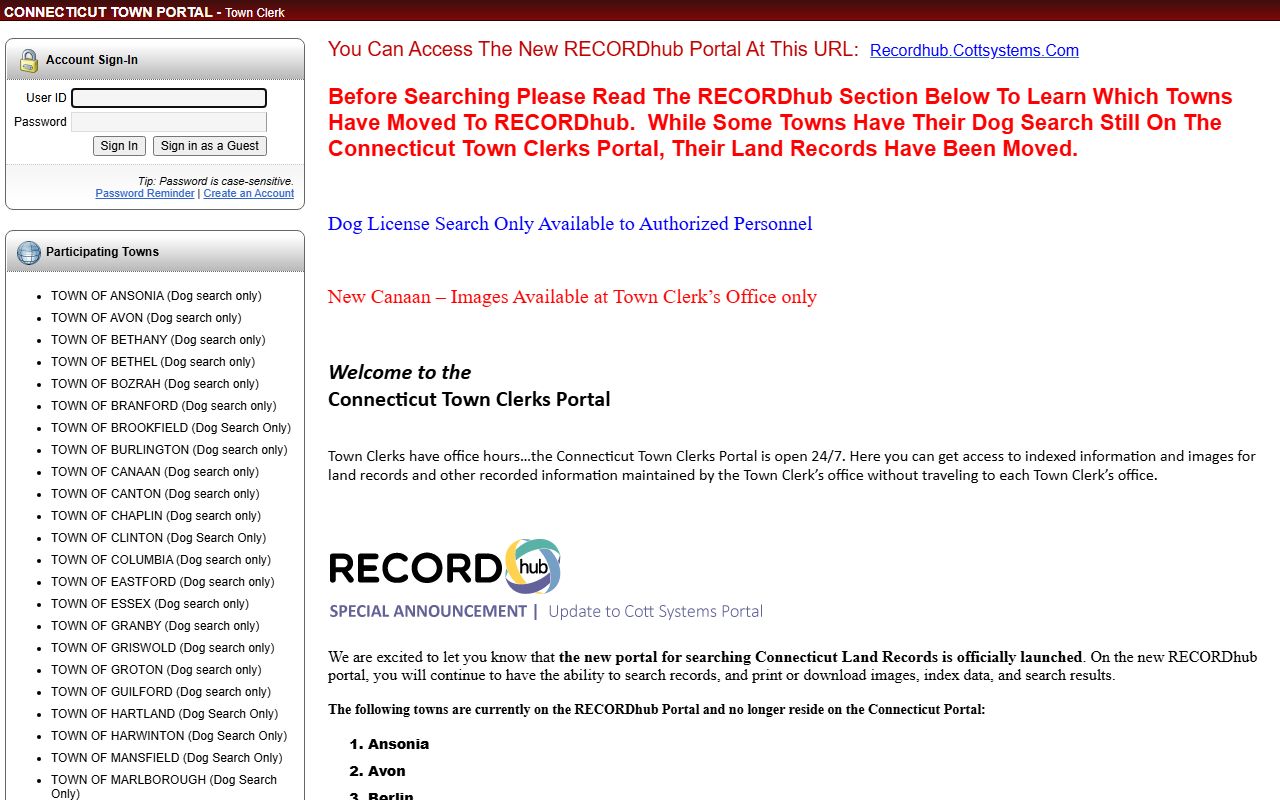

You can also use the Connecticut Town Clerks Portal to search Meriden records. This statewide system covers more than 70 towns. Select Meriden from the list, then enter your search terms. Results appear within seconds. For certified copies, contact the City Clerk directly. Online searches are for informational purposes. Official copies come from the clerk with a certification stamp and require payment of copy and certification fees.

Free Property Alert Service

Meriden offers a free Property Alert Service. This service sends you email notifications when a document is recorded under your name. You can sign up online through the city clerk's website. The service helps you detect property fraud early. If someone tries to record a fraudulent deed or mortgage on your property, you will receive an alert right away. This gives you time to contact the clerk, hire an attorney, and take legal action to protect your rights.

The Property Alert Service does not prevent fraud from happening. It simply notifies you when a document is recorded. You are responsible for monitoring your alerts and responding to suspicious activity. If you receive an alert for a document you did not authorize, contact the Meriden City Clerk immediately. They can tell you what was recorded and when. You should also consult an attorney and consider filing a police report. Property fraud is a serious crime, and early detection makes it easier to resolve.

Meriden Quick Facts

Recording Fees in Meriden

As of July 1, 2025, the recording fee in Meriden is $70 for the first page and $5 for each additional page. These fees are set by state law under Connecticut General Statutes Section 7-34a. If your document involves a nominee like MERS, the first page costs $160. The state adds a $2 fee for conveyances with consideration over $2,000. This surcharge funds the conveyance tax reporting system managed by the Department of Revenue Services.

Additional fees apply if your document is missing required information. If the grantee's current mailing address is not on the deed, the clerk adds $5. If names are not printed beneath signatures, you pay an extra $1. Copies of documents cost $1 per page. Certification adds $2 per document. Maps cost $20 to file, or $30 if the map shows a subdivision with three or more parcels. These fees are the same across Connecticut.

Document Requirements

All deeds recorded in Meriden must meet state formatting requirements. The document must be on white paper, either 8.5" x 11" or 8.5" x 14". Use black ink and a font size of at least 10 points. The grantor must sign the deed, and their name must be printed beneath the signature. The grantee's current mailing address must appear somewhere on the deed. Two witnesses must attest to the grantor's signature, and a notary must acknowledge it. The notary can serve as one of the two witnesses.

These rules come from Connecticut General Statutes Title 47, which governs land records statewide. Section 47-10 requires all conveyances to be recorded in the town where the land is located. Section 47-5 and 47-36c set out the requirements for proper execution and acknowledgment. If your document does not meet these standards, the city clerk will reject it. You must fix the problems and resubmit.

The image above shows Connecticut General Statutes Chapter 821, which covers land and land titles. Section 47-10 requires all deeds to be recorded in the city or town where the property is located. Sections 47-33b through 47-33l make up the Marketable Record Title Act. These laws apply to Meriden and every other Connecticut municipality.

Conveyance Tax in Meriden

When property changes hands in Meriden, both state and local conveyance taxes apply. The state rate is 0.75% on the first $800,000 of a residential sale and 1.25% on the amount over $800,000. Non-residential property is taxed at 1.25% on the full sale price. Meriden also imposes a local conveyance tax. The local rate varies by municipality, but it is typically 0.25% to 0.5%. Check with the city clerk for the current local rate.

You report these taxes using Form OP-236, the Connecticut Real Estate Conveyance Tax Return. This form must be filed electronically through the Department of Revenue Services. The city clerk forwards a copy to the state within 10 days of recording. If your transaction involves more than two grantors, attach Schedule A. Multiple grantees or an entity grantee require Schedule B. Some transfers are exempt from conveyance tax, including gifts between family members and certain trust transfers.

E-Recording Services

Meriden accepts electronic recordings through four approved vendors. Simplifile is one of the most widely used. You set up an account, upload your document, and pay the recording fee plus a small vendor fee. The system submits the document to the Meriden City Clerk. The clerk reviews it and either records it or sends it back with a rejection notice. If recorded, you receive a digital copy with the official stamp and book-page reference.

The image above shows Simplifile, an e-recording vendor approved by Connecticut municipalities. E-recording saves time and money. You do not need to travel to the city clerk or wait in line. Other approved vendors include Corporation Service Company (CSC), eRecording Partners Network (ePN), and Indecomm. Each vendor works the same way. You upload the document, pay the fee, and receive a recorded copy electronically.

E-recording works for most land documents, including deeds, mortgages, releases, and assignments. Some transactions that require Form OP-236 may need to be filed in person. Check with your vendor or the clerk before submitting a conveyance electronically. Maps and subdivision plans may also require in-person filing. The Meriden City Clerk can tell you which documents are eligible for e-recording and which must be submitted on paper.

Types of Recorded Documents

The Meriden City Clerk records all documents that affect title to real estate. This includes warranty deeds, which provide full protection to the buyer, and quitclaim deeds, which transfer only the interest the grantor has. Mortgages are recorded when you borrow money to buy a house. When the loan is paid off, a release or discharge of mortgage is filed. Liens from contractors, tax authorities, and judgment creditors are also recorded.

Other documents include easements, which grant rights to use land for specific purposes like utilities or access roads. Affidavits of title clarify ownership when there is a name change or an error in a prior deed. Condominium documents, including master deeds and association bylaws, are filed when a new condo development is created. Land survey maps show property boundaries and dimensions. All of these records are public. Anyone can search them and request copies.

Marketable Title in Connecticut

Connecticut law requires title searches to go back 40 years. This rule is part of the Marketable Record Title Act, found in CGS Title 47. If you can show an unbroken chain of ownership for 40 years, you have marketable title. The root of title must be a document recorded at least 40 years ago. Claims or defects that arose before the root of title are extinguished unless they were re-recorded or fall under an exception.

This law simplifies title searches. Instead of going back to the original land grant, you only need to check 40 years of records. Meriden land records go back much further, but for most transactions, a 40-year search is enough. Title companies and attorneys use this law to determine if a property has clear title. Certain interests, like easements and mineral rights, may survive even if they are older than 40 years.

The Connecticut Town Clerks Portal serves more than 70 towns and cities, including Meriden. This portal is open 24 hours a day and lets you search land record indexes and view document images. The image above shows the portal homepage. You select the municipality you want to search, then enter a name, date, or document type.

Legal Resources in Meriden

If you need legal advice about deed records, hire an attorney. The city clerk cannot give legal advice or tell you which type of deed to use. An attorney can prepare deeds, review title, and handle complex transactions. The Connecticut Secretary of the State provides business services and notary information, but does not offer legal referrals.

Legal aid organizations serve low-income residents who cannot afford private attorneys. Statewide Legal Services of Connecticut offers help with housing issues, which sometimes involve deed questions. Their services are free for those who qualify. You can find contact information on the Connecticut Judicial Branch website.

Nearby Cities and Towns

Meriden is located in central Connecticut in New Haven County. Wallingford is to the south. New Haven is further south along Interstate 91. Waterbury is to the west. Each municipality has its own clerk, its own online system, and its own office hours. If you own property in multiple towns, you must search each one separately.

When researching property in the Meriden area, make sure you know which town the land is in. Addresses can be misleading, especially near town borders. Check the property tax bill or ask the seller to confirm the municipality name. Recording a deed in the wrong town can delay closing and create title problems that are expensive to fix.