Search New Haven Deed Records

New Haven's City Clerk maintains all land records for property within city limits. This includes deeds, mortgages, releases, quit claims, and liens. The office is located at 200 Orange Street, Room 202. Recording hours run Monday through Friday from 9:00 AM to 4:00 PM. You can search deed records online or visit the office in person. The city participates in the statewide land records portal, which provides 24/7 access to indexes and images. New Haven processes and records thousands of land documents each year. All transfers must be recorded here to protect your ownership rights. The clerk also offers a fraud alert service that sends email notifications when documents are recorded in your name, helping protect against fraudulent filings.

New Haven Quick Facts

New Haven County Recording Structure

New Haven deed records are kept at the city level, not the county. Connecticut abolished county government functions long ago. All 27 towns and cities in New Haven County operate their own land records offices. There is no central repository. If property sits in New Haven, you file with the New Haven City Clerk. Property in Waterbury goes to the Waterbury Town Clerk, and so on.

This decentralized system means you need to know the exact municipality where property is located. A single parcel is always in one town or city. That office holds all deeds, mortgages, and other documents affecting that property. The clerk indexes everything by grantor and grantee name.

Online Land Records Access

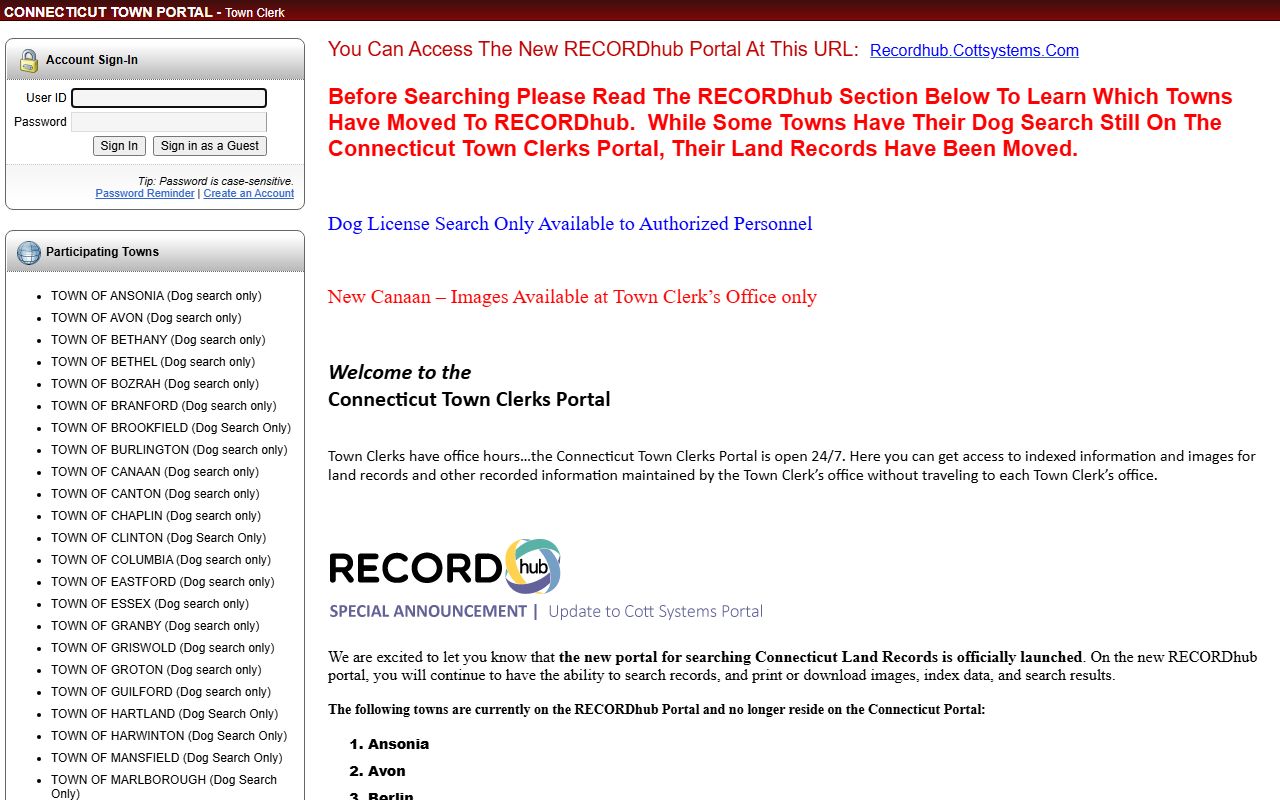

New Haven provides online access through the SearchIQS platform. You can search land records at the dedicated portal for the city. The system lets you search by name, date range, or document type. Indexes are free to view. Subscription access allows you to print and save document images.

The city also participates in the broader Connecticut Town Clerks Portal. This statewide system covers over 70 towns. You can search multiple municipalities at once if you have a subscription. Records date back decades in most towns, including New Haven.

Fraud Alert Service

New Haven offers a free fraud alert service through SearchIQS. Sign up to receive email notifications when any document is recorded containing your name. This helps detect fraudulent deeds or liens filed without your knowledge. The service monitors new recordings daily and sends alerts within 24 hours. Visit the city clerk website to register for this protection.

Property fraud can happen when someone forges your signature on a deed or mortgage. Recording a fake document creates a cloud on your title. The fraud alert system gives you early warning so you can contact authorities and resolve the issue quickly.

Recording Fees and Costs

New Haven charges $70 to record the first page of a deed. Each additional page costs five dollars. Nominee documents like MERS assignments have a $160 flat fee for the first page. Other MERS documents cost $160 for page one and five dollars for each additional page. These fees took effect July 1, 2025 under state law.

If the deed is missing the grantee address, add five dollars. Names not typed under signatures cost one dollar extra. A two dollar surcharge applies when the transfer value exceeds $2,000. This surcharge goes to the state for processing the conveyance tax return.

Copies cost one dollar per page. Certified copies add two dollars per document. Map filings cost $20 for standard maps and $30 for subdivision maps with three or more parcels. The clerk uses these fees to cover staff time, indexing, and document preservation.

Requirements for Recording a Deed

Connecticut law sets strict requirements for recording. The deed must be in writing and signed by the grantor. A notary public must acknowledge the signature. Two witnesses must attest to the signing, and the notary may count as one witness. All names must be printed or typed beneath signatures.

The grantee's current mailing address must appear on the deed. Use black ink only. Font size must be at least ten points. Paper must be white, either letter or legal size. Documents that fail these standards will be rejected. The rules appear in Connecticut General Statutes Title 47.

Any deed with consideration over $2,000 requires Form OP-236, the Real Estate Conveyance Tax Return. This form must accompany the deed at recording. The clerk will not accept a deed without the proper tax forms.

City Clerk Office Hours and Services

The New Haven City Clerk office is open Monday through Friday from 9:00 AM to 5:00 PM. Recording hours end at 4:00 PM. Arrive before 4:00 PM if you need to file a document that day. Documents received after 4:00 PM will be held until the next business day.

The clerk's office provides several services beyond land records:

- Vital records (birth, death, marriage certificates)

- Notary public commissions

- Justice of the peace commissions

- Dog licenses

- Liquor permit applications

- Trade name certificates

- Board of Alderpersons legislation

- City contracts and legal documents

Call (203) 946-8339 to verify hours or ask about specific services. Staff can guide you through the process of recording documents or obtaining copies of existing records.

Electronic Recording Options

New Haven accepts electronic recording through approved vendors. These include Simplifile, Corporation Service Company, eRecording Partners Network, and Indecomm Global Services. Attorneys and title companies use these services to submit documents from their offices without visiting the clerk.

E-recording saves time and reduces errors. The system validates documents before submission. If something is missing or incorrect, the vendor notifies you immediately. Once accepted, the clerk records the document during business hours. You receive confirmation with the book and page number electronically. This speeds up closings and loan transactions.

Types of Land Records

The New Haven City Clerk records several types of land documents:

- Warranty deeds transferring full ownership

- Quitclaim deeds releasing any interest

- Mortgage deeds pledging property as security

- Releases and discharges of mortgages

- Liens from contractors, tax authorities, or courts

- Easements granting rights of way

- Lis pendens notices of pending lawsuits

- Maps and surveys showing property boundaries

Each document is indexed by the names of all parties. You can search by the person giving an interest (grantor) or receiving an interest (grantee). The index shows the recording date, document type, and location in the records. From there you can pull the full text and images.

Conveyance Tax in New Haven

Connecticut charges a state conveyance tax when property is sold. For residential property up to $800,000, the rate is 0.75 percent. Amounts over $800,000 pay 1.25 percent on the excess. Non-residential property pays 1.25 percent on the full sale price. New Haven may also impose a local conveyance tax. Check with the city clerk at (203) 946-8339 for the current local rate.

The Department of Revenue Services collects conveyance taxes. Form OP-236 calculates what you owe. Submit the form with payment when recording the deed. The city clerk forwards your payment to DRS within ten days. Without this form, the clerk cannot record a taxable transfer.

Title Searches and the Marketable Record Title Act

Connecticut requires a 40-year chain of title under the Marketable Record Title Act. This law appears in CGS Sec. 47-33b through 47-33l. Title searchers look back four decades to establish the root of title. Claims or defects older than 40 years are automatically extinguished. This simplifies proving clean ownership.

Title companies and attorneys perform these searches before property sales. They review all deeds, mortgages, liens, and judgments in the chain. The goal is to find any issues that could affect your ownership. Lenders require clear title before approving a mortgage. Title insurance protects you if a hidden problem emerges later.

Note: Recording your deed gives public notice and protects your interest against later buyers or creditors.

Other City Resources

For property tax information, contact the New Haven Tax Assessor. They maintain records of property values and tax bills. For building permits and zoning, check with the city's Department of Livable City Initiatives. For court cases involving property disputes or foreclosures, search records at the Connecticut Judicial Branch.

The New Haven Register of Deeds is part of the city clerk's office. There is no separate register. All land recording functions are handled by the city clerk and staff.

Nearby New Haven County Cities

Other major cities in New Haven County with their own land records offices:

Each city operates independently. You cannot search Waterbury deeds at the New Haven clerk's office. Always go to the municipality where the property is located.