New London Property Records

New London keeps all deed records at the City Clerk office on 181 State Street. The office handles land records, vital statistics, and public documents. If you own property in New London or plan to buy here, these records matter. Every transfer, mortgage, lien, or easement affecting city property gets filed with the clerk. Office hours run Monday through Friday from 8:30 AM to 4:00 PM. Title searches require an appointment. Call (860) 447-5200 or (860) 447-5204 to schedule. The clerk maintains indexes going back many decades. Older records may be in bound volumes. Recent filings are available online through the statewide portal. Recording a deed here protects your ownership against later claims.

New London Quick Facts

New London County Land Records

Connecticut has no county recording of land records. Each of the 22 towns in New London County maintains its own system. New London City Clerk handles all property within city limits. Norwich has its own office. Groton has another. If you need a deed from a different town, you must go to that town's clerk.

This structure dates to colonial times when towns were the primary unit of government. The state never created county recorders. Today, each clerk operates independently. Some share online platforms, but the records themselves stay local. You cannot search New London deeds at the Norwich clerk's office or vice versa.

Searching Land Records Online

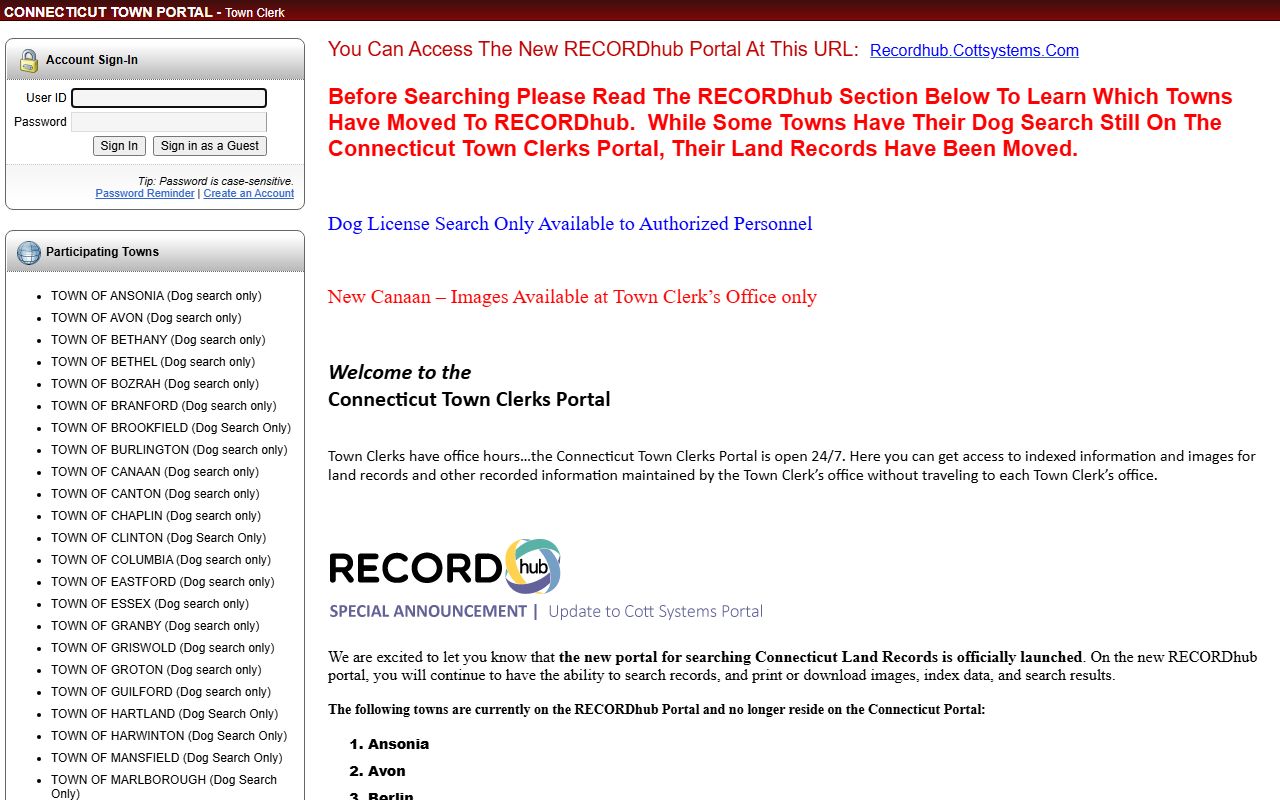

New London participates in the Connecticut Town Clerks Portal. This statewide system offers 24/7 access to land record indexes and images. You can search by name, date, or document type. The portal shows scanned copies of recorded documents. Over 70 Connecticut towns participate in this system.

The portal is free to search. Viewing and printing require a subscription. Costs vary by vendor and level of access. You can also use US Land Records, which provides multi-town searching across Connecticut. Select New London from the list to view records specific to the city.

Recording Fees in New London

The standard recording fee is $70 for the first page. Each additional page costs five dollars. These fees went into effect July 1, 2025 under Public Act 25-168. Nominee documents like MERS have a flat $160 fee for the first page. Other MERS documents cost $160 for page one and five dollars for each extra page.

Missing a grantee address adds five dollars. Names not printed under signatures cost one dollar extra. A two dollar surcharge applies when consideration exceeds $2,000. This helps cover the cost of processing the conveyance tax return. Copies cost one dollar per page. Certified copies add two dollars per document.

Map filings cost $20 for standard maps. Subdivision maps with three or more parcels cost $30. These fees support the clerk's operations and document preservation efforts.

Document Requirements

A deed must meet specific standards to be recorded in New London. It must be in writing and signed by the grantor. A notary public must acknowledge the signature. Two witnesses must attest, with the notary counting as one. All signatures need typed or printed names beneath them.

The deed must include the grantee's current mailing address. Use black ink and at least ten point font. Paper must be white, either 8.5 by 11 inches or 8.5 by 14 inches. These rules come from Connecticut General Statutes Title 47, which governs land records statewide.

Any deed transferring property for more than $2,000 requires Form OP-236, the Real Estate Conveyance Tax Return. This form must be filed with the deed. Without it, the clerk cannot record the transfer.

In-Person Recording and Title Searches

The New London City Clerk office is located at 181 State Street. Bring your original document and any required forms. Staff will review the document for completeness. If approved, they stamp it with the recording date and time. You receive a receipt with the book and page number where your document is recorded.

Title searches require an appointment. Call ahead at (860) 447-5200 to schedule. A title search involves reviewing all deeds, mortgages, and liens affecting a property. The clerk has indexes organized by grantor and grantee name. You look up names to find volume and page numbers, then pull the actual documents.

Copies cost one dollar per page. Certified copies add two dollars. Certification means the clerk attests that the copy is a true reproduction of the original. Courts and lenders often require certified copies.

Electronic Recording in New London

New London accepts electronic recording through approved vendors. These include Simplifile, Corporation Service Company, eRecording Partners Network, and Indecomm Global Services. Attorneys and lenders can submit documents from their offices without visiting the clerk.

The e-recording system checks documents for proper formatting. If something is wrong, you get immediate feedback. Once the document passes validation, the clerk processes it during business hours. You receive electronic confirmation with the official recording information. This process is faster than mail or in-person delivery.

Types of Recorded Documents

The New London City Clerk records many types of land documents:

- Warranty deeds conveying full ownership

- Quitclaim deeds releasing any interest

- Mortgage deeds securing loans with property

- Releases of mortgages when loans are paid off

- Liens from mechanics, tax authorities, or courts

- Easements granting rights of way

- Lis pendens notices of pending lawsuits

- Foreclosure documents and sheriff's deeds

All documents are indexed by the names of parties involved. You can search by grantor (seller) or grantee (buyer). The index shows the date, document type, and book and page number. This helps you locate specific records quickly.

Conveyance Tax Information

Connecticut charges a state conveyance tax on property transfers. For residential property up to $800,000, the rate is 0.75 percent. Amounts over $800,000 pay 1.25 percent on the excess. Non-residential property pays 1.25 percent on the full amount. New London may also charge a local conveyance tax. Contact the city clerk at (860) 447-5200 for the current local rate.

The Department of Revenue Services collects these taxes. Form OP-236 calculates what you owe. Submit the form with payment when recording the deed. The clerk forwards your payment to DRS within ten days. Without this form, taxable transfers cannot be recorded.

The 40-Year Title Rule

Connecticut's Marketable Record Title Act requires a 40-year chain of title. The law appears in CGS Sec. 47-33b through 47-33l. Title searchers look back four decades to find the root of title. Any defects or claims older than 40 years are extinguished. This makes it easier to establish clear ownership.

Title companies and real estate attorneys perform these searches before sales. They review all recorded documents in the chain. The goal is to identify any issues that could affect your ownership. Lenders require clean title before approving a mortgage. Title insurance protects buyers and lenders if problems surface later.

Note: Recording your deed gives public notice and protects you against subsequent buyers or creditors.

Additional City Clerk Services

The New London City Clerk handles several other functions besides land records:

- Vital records (birth, death, marriage certificates)

- Elections administration and voter registration

- Notary public commissions

- Dog licenses

- Trade name certificates

For property tax records, contact the New London Tax Assessor. For building permits and zoning, check with the city's Planning and Development office. For court cases involving property, search at the Connecticut Judicial Branch.

Nearby New London County Towns

Other towns in New London County with land records offices:

Each town keeps separate records. You must visit the clerk in the town where the property is located. There is no central office for New London County. Property tax rates and median home values vary across the county. The median home value in New London County is around $390,000, with a property tax rate near 2.72 percent.