Find Windham County Property Deeds

Windham County land records are filed with Town Clerks in each of the 16 towns that comprise this northeastern Connecticut county. No county-level recorder exists in Connecticut. All deeds, mortgages, liens, maps, and other instruments affecting real property are recorded at the town level. The county has about 115,000 residents. Windham is the county seat. Willimantic serves as the commercial center and is part of the town of Windham. Most communities are small, rural, or suburban. Eastern Connecticut State University is located in Willimantic. Many towns have historic village centers with properties dating back to colonial times. Land records in some towns go back to 1692. Online access varies by town. Some have digitized records available for searching. Others require office visits to access older documents. To find a deed, you need to know which town the property is in and contact that Town Clerk office.

Windham County Quick Facts

Windham County Recording System

Connecticut does not have county recorders. Land recording is done at the town level. This has been true since colonial times. Each town has a Town Clerk who serves as the recorder of deeds for that municipality. State law requires recording in the town where the land is located. Recording in the wrong town provides no legal notice. Windham County has 16 towns. Each operates its own land records system independently.

The 16 towns are Ashford, Brooklyn, Canterbury, Chaplin, Eastford, Hampton, Killingly, Plainfield, Pomfret, Putnam, Scotland, Sterling, Thompson, Windham, and Woodstock. Some towns also have boroughs with their own government but not separate land records. Willimantic is a borough in the town of Windham. Danielson is part of Killingly. All land records are kept by the town. Populations range from a few hundred in small towns like Hampton to over 25,000 in larger communities. Most towns are rural with farms, forests, and small residential areas.

Windham is the county seat and a good example of how the system works. The Town Clerk office at 979 Main Street in Willimantic maintains all land records for properties in the town. Online access is available. Records prior to 1966 have been filmed and are searchable on IQS platforms. Newer records are digital. The office also offers fraud alert services where you can register to receive email notifications when documents are recorded under your name. This helps detect fraudulent deeds.

How to Record a Deed

To record a deed in Windham County, you bring it to the Town Clerk office where the land is located. Most towns accept walk-in recordings during business hours. The clerk reviews the document to verify it meets state requirements. If acceptable, the clerk stamps it with the recording date and time, assigns a book and page or document number, and files it in the town's land records. You receive the original back with the recording information. The document is now part of the permanent public record.

You can also record by mail. Send the original document, a check for the recording fee made out to the town, and a self-addressed stamped envelope for return. Processing takes several days. E-recording is faster and more convenient. Most Windham County towns accept electronic recording through approved vendors like Simplifile, CSC, ePN, or Indecomm. You upload the document as a PDF, pay the fee online, and receive the recorded document back electronically, usually within one business day.

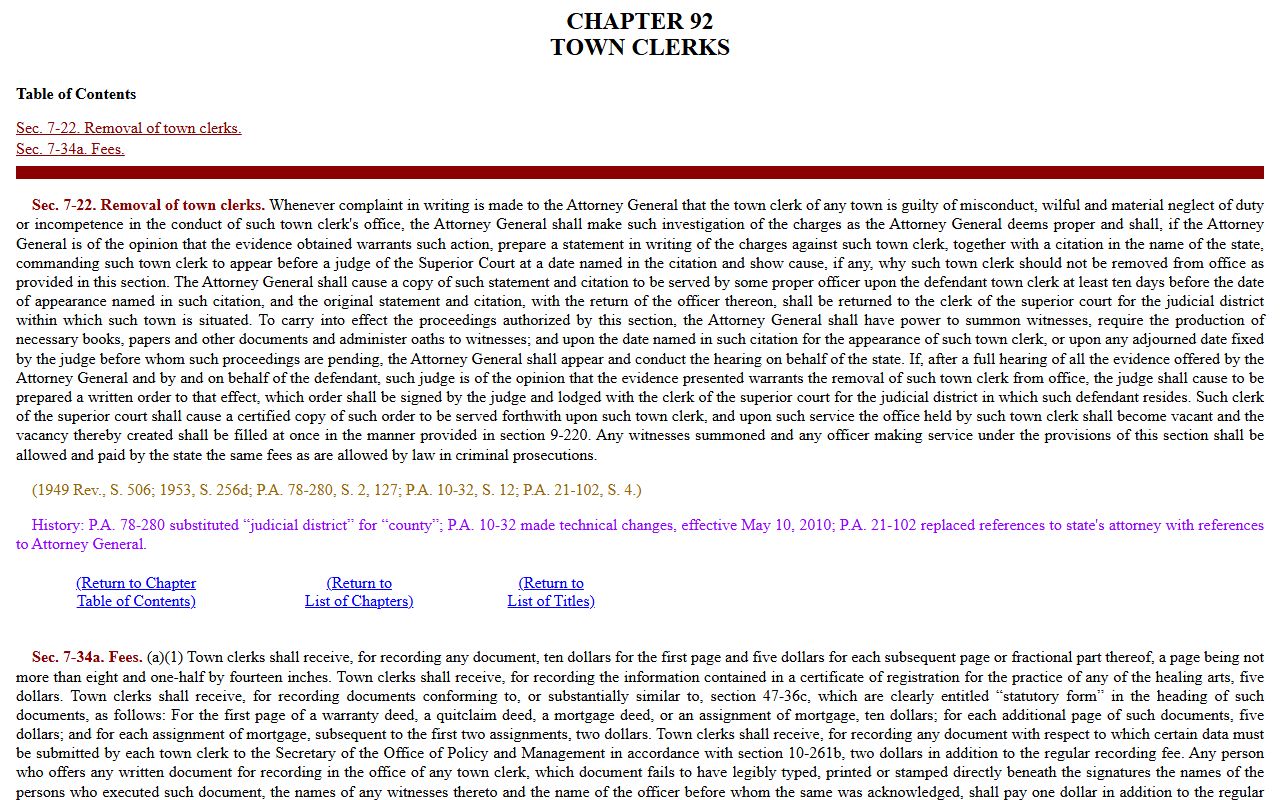

Recording fees are set by Connecticut statute. The standard fee is $70 for the first page and $5 for each additional page. This applies to deeds, mortgages, releases, easements, and similar instruments. Nominee documents like MERS assignments cost $160 flat fee. Other MERS documents are $160 for the first page and $5 per additional page. If the deed involves a sale over $2,000, you must submit Form OP-236 for conveyance tax. The state conveyance tax is 0.75% for residential property up to $800,000 and 1.25% for amounts over $800,000 or for commercial property. Towns also charge a municipal conveyance tax, typically 0.25% to 0.50%.

Legal Requirements for Recording

Connecticut law sets specific requirements for deeds and other recordable documents. The document must be in writing and signed by the grantor. It must be acknowledged before a notary public. Two witnesses are required. The notary can be one witness. All signatures must have names printed or typed beneath them. The grantee's current mailing address must appear on the deed. Use black ink with a minimum 10-point font. Paper must be white, 8.5 by 11 inches or 8.5 by 14 inches. Leave margins for the Town Clerk's recording stamp.

These requirements come from Connecticut General Statutes Title 47, which governs land titles. Section 47-10 is the key provision. It states that no conveyance is effective to hold land against any other person except the grantor and his heirs unless it is recorded in the town where the land lies. Recording provides public notice and establishes priority. An unrecorded deed is valid between the parties but does not protect against later purchasers or creditors.

Connecticut uses a race-notice recording system. The first person to record a deed has priority, provided they did not have notice of an earlier unrecorded interest. This makes prompt recording essential. Delays can create serious title problems. If someone else records first, they may take priority even if your deed is older. Title searches in Connecticut typically go back 40 years under the Marketable Record Title Act, found in CGS Sections 47-33b through 47-33l. This statute creates marketable title after 40 years and extinguishes older claims and defects.

Online Access and Searches

Several Windham County towns offer online land records access. Windham uses IQS platforms with records searchable online. Records prior to 1966 are filmed and available. Newer records are digital. You can search by grantor, grantee, date, or book and page. Some towns participate in the Connecticut Town Clerks Portal, a statewide system with 24/7 access. Others use US Land Records or RecordHub. Viewing indexes is usually free. Printing or downloading documents may require a subscription or per-page fee.

Not all towns have complete online records. Smaller towns may only have recent years online. Older documents, especially those before 1970, often exist only in paper form. Maps and plans are rarely digitized. Very old deeds may be handwritten in script that is difficult to read. Some Windham County towns have records dating to 1692. These early documents are kept in fireproof vaults and access may be restricted to preserve them.

If you need original records or certified copies, contact the Town Clerk. Certified copies have the town seal and clerk's signature. They are required for closings and legal proceedings. The cost is $1 per page plus $2 for certification. In-person access is free at the Town Clerk office during business hours. You can view records and take notes. Some offices have copy machines for a fee.

Fees and Conveyance Taxes

Recording fees in Connecticut are set by state law. As of July 1, 2025, the fee is $70 for the first page and $5 for each additional page. This applies to all standard documents. MERS nominee assignments and releases cost a flat $160. Other MERS documents are $160 for the first page and $5 per additional page. Maps cost $20 to file. Subdivision maps with three or more parcels cost $30. These fees are the same in all Connecticut towns.

Additional surcharges apply. If the grantee's address is missing from the deed, add $5. If names are not printed beneath signatures, add $1. If the deed involves consideration over $2,000, add $2 for the conveyance tax processing fee. These rules are found in CGS Section 7-34a.

Conveyance taxes are separate from recording fees. The state tax rate is 0.75% for residential property up to $800,000 and 1.25% for amounts over $800,000. Commercial property is taxed at 1.25% on the full amount. Unimproved land is 0.75%. Each town also imposes a municipal conveyance tax. Rates vary but are typically 0.25% to 0.50%. Form OP-236 must accompany all deeds with consideration over $2,000. This form has two copies. One stays with the Town Clerk. One goes to the Department of Revenue Services. The clerk forwards the DRS copy within 10 days. You pay both state and municipal taxes at recording.

E-Recording and Modern Services

Most Windham County towns accept e-recording. This lets you submit documents online without visiting the Town Clerk office. Four vendors are approved statewide: Simplifile, Corporation Service Company (CSC), eRecording Partners Network (ePN), and Indecomm Global Services. You register with one or more vendors, upload your document as a PDF, pay fees by credit card, and submit. The Town Clerk reviews and records it electronically, then returns the recorded version with the book and page or document number.

E-recording is faster than paper or mail. Processing is usually within one business day. You can submit 24/7. There is no travel required. Errors can be fixed and resubmitted quickly. However, not all document types are eligible. Some clerks do not accept Form OP-236 transactions via e-recording. Check with the town before submitting. E-recording fees are the same as paper fees, but vendors may charge a small transaction fee.

To start e-recording, contact the Town Clerk to get a customer ID. Then register with a vendor. Simplifile is at (800) 460-5657. CSC is at (866) 652-0111. ePN is at (888) 325-3365. Indecomm is at (651) 766-2350. If you record frequently, e-recording saves time. For occasional users, paper recording may be simpler.

Fraud Alerts and Property Protection

Some Windham County towns offer property fraud alert services. You register your name and property information with the Town Clerk's database. If any document is recorded with your name, you receive an email alert. This helps detect fraudulent deeds or unauthorized mortgages. Property fraud has increased in recent years. Criminals forge deeds and transfer property without the owner's knowledge. Alert services provide an early warning.

Windham offers fraud alert sign-up through its online land records system. Alerts are free in most towns. You can register multiple properties and names. Alerts are sent within 24 hours of recording. If you receive an alert for a document you did not authorize, contact the Town Clerk immediately. You may need to file a police report and work with an attorney to void the fraudulent document. Windham also has forms available for removing unlawful restrictive covenants from old deeds.

Historical Records

Windham County has some of the oldest land records in Connecticut. Town Clerks have maintained birth, marriage, and land records since 1692 in some towns. Early deeds are handwritten in script. Ink has faded. Paper is fragile. Many old documents use colonial-era measurements like rods and chains. Property descriptions reference landmarks that no longer exist. Trees, stones, roads, and streams mentioned in 17th and 18th century deeds may be gone.

These historical records are kept in fireproof vaults at Town Clerk offices. Access may be restricted to preserve them. You can view them under supervision. Photocopying may not be allowed. Digital photography might be permitted with permission. Some towns have microfilmed or digitized older records. Others have not. If you are researching family history or historic properties, contact the Town Clerk to ask about access and availability.

Towns in Windham County

Windham County has 16 towns but no cities over 25,000 population. The largest is Windham with about 25,000 residents if you count the borough of Willimantic. Other towns include Ashford, Brooklyn, Canterbury, Chaplin, Eastford, Hampton, Killingly, Plainfield, Pomfret, Putnam, Scotland, Sterling, Thompson, and Woodstock. Most are small rural communities. Each has a Town Clerk office that maintains land records. Hours and services vary. Contact each town for specific information.

Nearby Counties

Windham County borders several other Connecticut counties. To the west is Tolland County with 13 towns. To the south is New London County with 22 towns. Each follows the same town-based recording system. If property is near a county line, verify which town it is in before searching records. County boundaries do not always align with visible features. Town boundaries are the critical factor for land records.